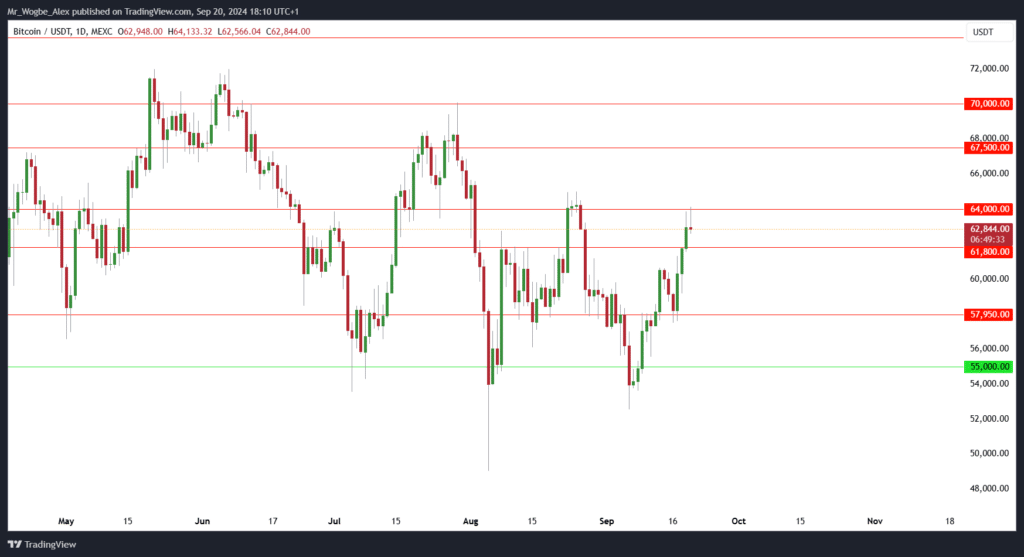

Bitcoin, the world’s largest cryptocurrency, has climbed above $63,000 as investors react positively to recent economic developments. The digital currency’s price rose 2.3% in the past 24 hours, peaking at $64,127 at the time of writing.

This upward trend comes after the U.S. Federal Reserve cut interest rates by 50 basis points on Wednesday. The rate cut, which lowers the cost of borrowing money, has created a more favorable environment for risky investments like Bitcoin.

Market analyst Rachael Lucas from BTCMarkets explained:

“Bitcoin is showing a strong short-term upward trend. Over the past week, it has posted three days in a row of price increases, reflecting an 8% rise.”

Lucas noted that Bitcoin’s price gains have matched those seen in traditional stock markets like the S&P 500 and Nasdaq. This suggests that investors are currently more willing to take risks across different types of investments.

However, Lucas cautioned that for a true bull market to take hold, more everyday investors would need to start buying Bitcoin. Right now, the number of regular people investing in Bitcoin remains low.

MicroStrategy Stocks Up on Bitcoin

Adding to the positive sentiment, MicroStrategy, a business intelligence company known for its large BTC holdings, announced it had bought even more of the cryptocurrency. The company purchased 7,420 bitcoins for about $458.2 million, paying an average price of $61,750 per bitcoin.

MicroStrategy has acquired 7,420 BTC for ~$458.2 million at ~$61,750 per #bitcoin and has achieved BTC Yield of 5.1% QTD and 17.8% YTD. As of 9/19/2024, we hodl 252,220 $BTC acquired for ~$9.9 billion at ~$39,266 per bitcoin. $MSTR https://t.co/JUtgztpzBu

— Michael Saylor⚡️ (@saylor) September 20, 2024

With this latest purchase, MicroStrategy now owns 252,220 Bitcoin, worth around $15.8 billion. The company has spent a total of $9.9 billion buying Bitcoin, at an average price of $39,266 per coin.

MicroStrategy’s founder, Michael Saylor, shared these details in a recent report to financial regulators. The company’s continued investment in Bitcoin shows that some large investors remain confident in the cryptocurrency’s future.

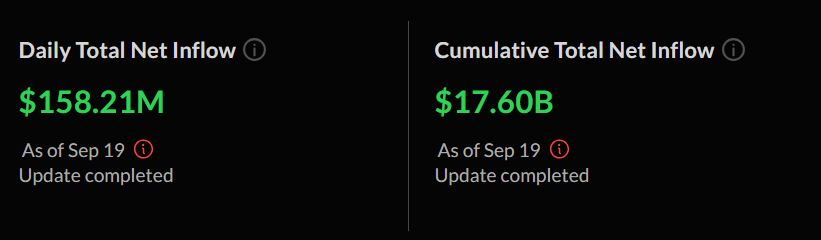

BTC ETFs Record Bullish Turnaround

In other news, U.S. spot Bitcoin exchange-traded funds (ETFs) saw $158.21 million flow into them on Thursday. This is a turnaround from the day before when $52 million was taken out of these funds.

The Ark Invest and 21Shares’ ARKB fund led the pack, bringing in $81.07 million. Fidelity’s FBTC fund followed with $49.88 million in new investments.

As Bitcoin’s price continues to rise, investors are watching closely to see if this upward trend will continue or if the market will face new challenges in the coming weeks.

Interested In Trading The Market With A Trustworthy Partner? Try LonghornFX Today.

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.