Recent analysis from CoinShares suggests that establishing a Bitcoin strategic reserve could have a more significant long-term impact on Bitcoin than the successful launch of ETFs. While 2024 witnessed record-breaking ETP inflows of $44.2 billion, institutional adoption remains limited due to professional stigma.

US Takes Bold Steps Toward Bitcoin Adoption

The United States is exploring two distinct approaches to creating a Bitcoin strategic reserve.

The first and most impactful option is Senator Cynthia Lummis’s proposed Bitcoin Act, which would require the US Treasury to buy 1 million bitcoins over five years, representing roughly 5% of Bitcoin’s total supply. These coins would be locked for 20 years unless used to pay national debt.

The second pathway involves a draft Executive Order that would direct the Treasury Department to:

- Keep all Bitcoin currently owned by US government departments

- Add Bitcoin to the Exchange Stabilization Fund (ESF)

- Use $21 billion from the ESF to purchase additional Bitcoin

Global Nations Follow Suit in Building a Bitcoin Strategic Reserve

Several countries are actively considering Bitcoin for their national reserves:

- Brazil’s Congress is reviewing a bill to allocate 5% of international reserves to Bitcoin

- El Salvador leads with Bitcoin as legal tender since 2021

- Japan’s lawmakers are examining potential conversion of foreign exchange reserves to Bitcoin

- Russia and Poland are exploring Bitcoin reserves to counter economic sanctions

- Argentina’s leadership supports Bitcoin as an alternative to central banking

Market Impact and Economic Implications

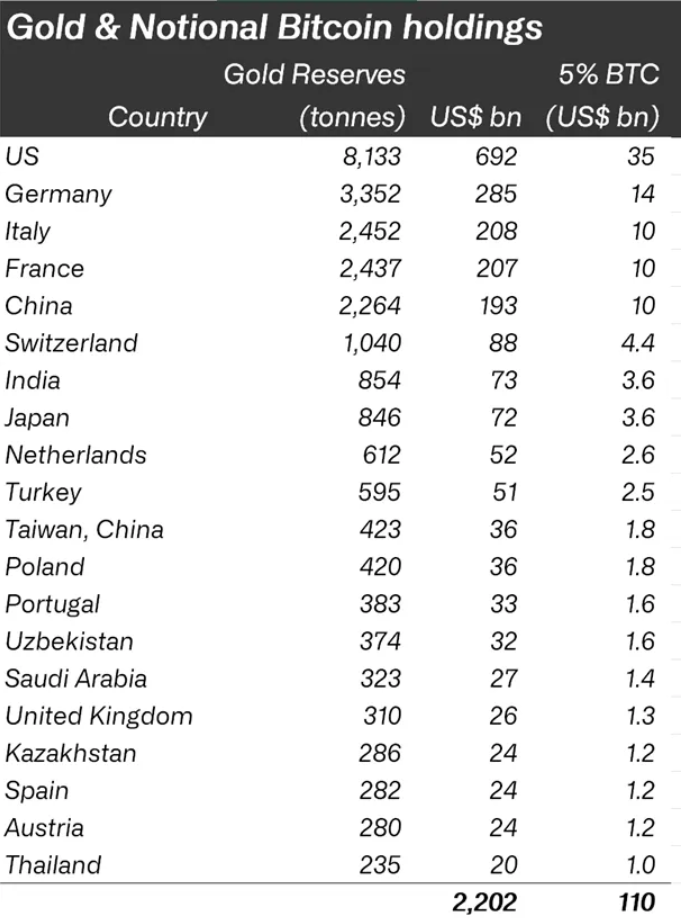

If the top 20 countries holding gold reserves followed the US example and converted 5% to Bitcoin, it would result in approximately $110 billion in Bitcoin purchases, representing 5.5% of total supply.

This shift could trigger significant price movements and reshape global monetary policy.

The dollar’s declining role as a reserve currency, falling from 71% in 2000 to 59% in 2022, adds urgency to these considerations. While critics argue that Bitcoin competes with the US dollar, proponents compare it to gold reserves, which governments already maintain for strategic purposes.

CoinShares emphasizes that transitioning to a “Bitcoin standard” would cause economic disruption. However, the firm argues that holding Bitcoin as a strategic reserve isn’t fundamentally different from maintaining gold reserves.

As central banks worldwide diversify their holdings, Bitcoin’s role as a hard, immutable asset makes it an increasingly attractive option for national reserves.

This potential policy shift could remove barriers to institutional adoption and spark a new wave of investment in Bitcoin, marking a significant evolution in global monetary policy and asset management strategies.

Interested In Trading The Market With A Trustworthy Partner? Try Eightcap Today.

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.