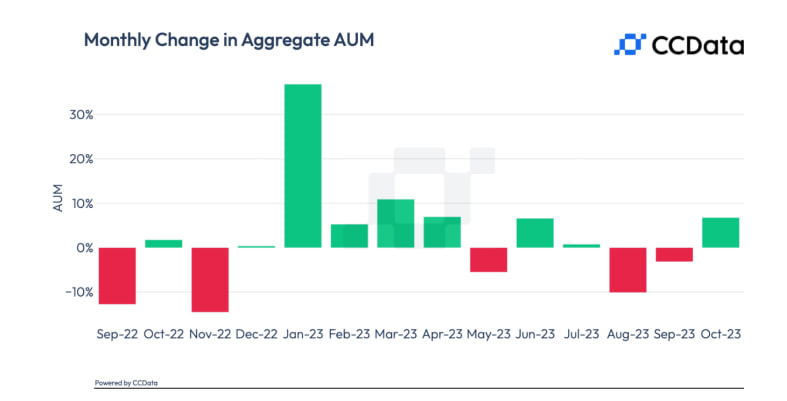

Crypto funds managing digital assets saw a notable upswing in October, breaking a two-month downturn. This growth surge was notably driven by increased investor anticipation of potential Bitcoin ETF approval in the U.S.

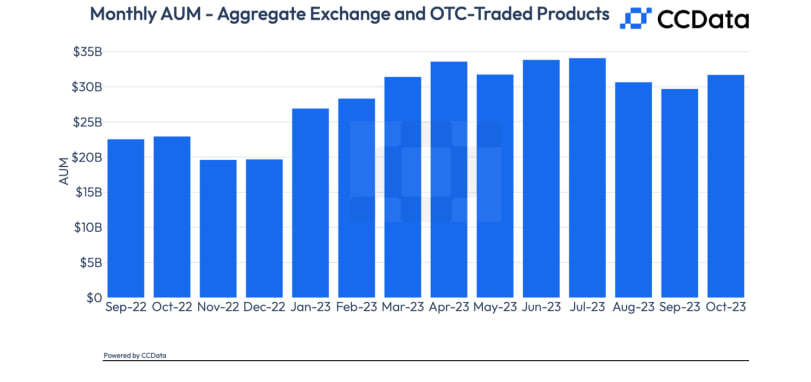

As per data from CCData, a benchmark administrator for crypto funds, the total assets under management (AUM) for digital products traded on exchanges and over the counter surged by 6.74% to reach $31.7 billion last month.

The rise in AUM was chiefly propelled by a remarkable 11% jump in Bitcoin’s price on October 16, with a local peak of $30,300. Fueling this rally were swirling rumors about BlackRock, the world’s largest asset manager, applying for a Bitcoin ETF spot.

Bitcoin, Solana, and Cosmos-Based Products Record Solid Gains for Crypto Funds

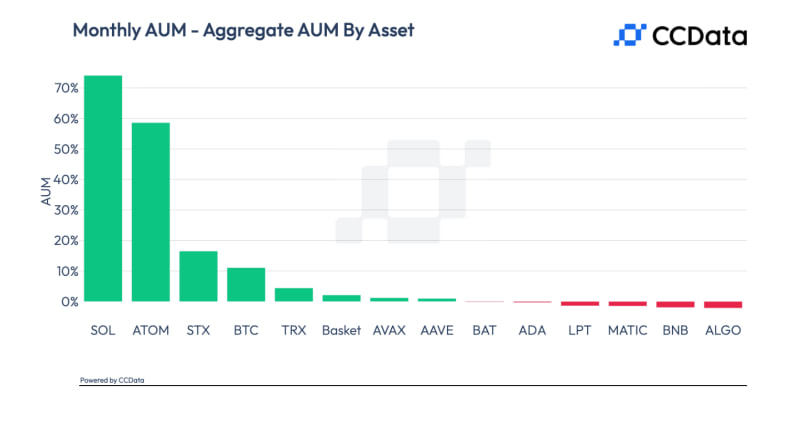

Bitcoin-based products took the lead, increasing their market share from 70.5% in September to 73.3%, while their AUM surged by 11.1% to $23.2 billion. Investors are confident about the U.S. Securities and Exchange Commission potentially approving several Bitcoin ETFs focusing on the underlying asset rather than futures contracts in early 2024.

On the flip side, products linked to Ether, Ethereum’s native token, saw a decline in AUM, falling by 5.45% to $6.35 billion. The market share of Ether-based products also dropped from 22.6% in September to 20.1%.

October’s notable performers were Solana and Cosmos, with their native tokens SOL and ATOM recording decent gains. SOL-based products experienced the highest AUM growth, surging by 74.1% to $140 million, while ATOM-based products posted an AUM growth of 58.6% to reach $2.15 million.

Moreover, basket-based products, which offer diversified portfolios of digital assets, witnessed a 2.10% AUM increase, reaching $1.19 billion.

This report from CCData indicates that crypto funds are gaining traction among investors as the digital asset space continues to evolve and mature. The anticipation of Bitcoin ETFs in the U.S. is a significant driving force behind this recent surge in crypto fund investments, making it a sector worth watching closely in the coming months.

Find Out More About Learn2Trade With Our FAQ. Click Here

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.