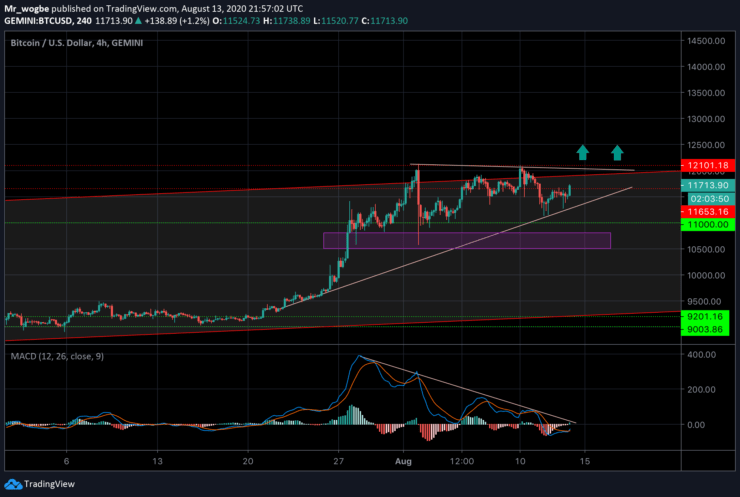

In the 4-hour timeframe, we can see that the base of the ascending wedge has been tested several times, but bears have been unable to take the price lower. However, bulls are also having a difficult time taking prices above the $11,800 level. This has cast a consolidation momentum on Bitcoin in the near-term as both bulls and bears recover.

Glancing at other markets, we can notice that Gold (XAU/USD) and Silver (XAG/USD) are in a strong rebound from a sharp decline that occurred on Tuesday.

Bitcoin has been showing an increasing-price correlation with the precious metals of late. When the strong reversal took place in the commodities, Bitcoin shed about $800 almost immediately.

Key Levels To Watch

With Silver showing good prospects for a recovery in the near-term, we could see Bitcoin recover as well to its previous highs before/by the weekend.

Also on the 4-hour chart, we can see that the 50 HMA and the 100 HMA have formed a mini channel for BTC over the past few days.

A break and close above the 50 HMA could serve as a signal that Bitcoin bulls are implementing a recovery as seen on the XAG/USD chart earlier today. If we get a comfortable break and close above the $11,750-800, the $12,000-100 resistance would be attempted once again. If Bitcoin finally defeats this region, we could be propelled to the $13,500 level fairly quickly.

Total Market Capital: $365 billion

Bitcoin Market Capital: $216 billion

Bitcoin Market Dominance: 59%

Note: Learn2.Trade is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.