In a dramatic turn of events, Bitcoin has experienced a significant price surge following the United States Federal Reserve’s decision to cut interest rates by 50 basis points. This move has sparked renewed optimism in the cryptocurrency market, with experts predicting potential new all-time highs for Bitcoin in the coming months.

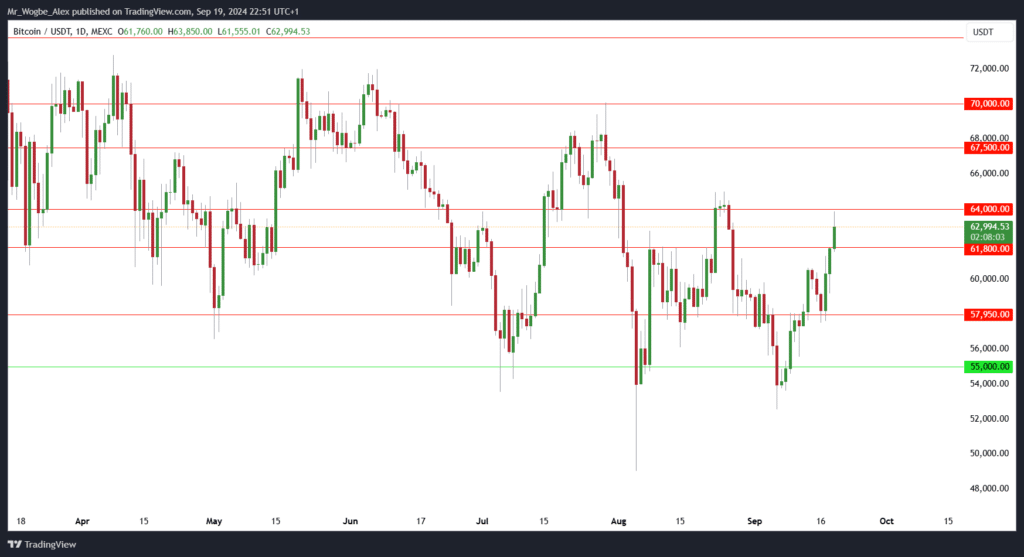

The world’s largest cryptocurrency by market capitalization is currently trading above $63,000, marking a notable increase from recent levels. This upward momentum comes as a direct response to the Fed’s monetary policy shift, which has created a more favorable environment for risk assets like Bitcoin.

According to Geoff Kendrick, head of forex and digital assets research at Standard Chartered, the recent rate cut is likely to have a sustained positive impact on Bitcoin and the broader digital asset market, as reported by The Block.

Kendrick suggests that macroeconomic factors are now playing a more significant role in driving cryptocurrency prices, potentially outweighing concerns related to the upcoming U.S. presidential election in November.

The potential for increased investment in spot Bitcoin exchange-traded funds (ETFs) is another factor that could support Bitcoin’s price in the near future. Kendrick anticipates renewed inflows into these investment vehicles starting in October, which could further boost demand for the cryptocurrency.

Looking ahead, Standard Chartered has set ambitious price targets for Bitcoin, with Kendrick reiterating his previous prediction of new all-time highs by the end of the year. The bank’s forecasts vary depending on the outcome of the U.S. presidential election, with potential targets of $125,000 if Donald Trump wins and $75,000 if Kamala Harris emerges victorious.

While political outcomes may still play a role in Bitcoin’s performance, Kendrick emphasizes that ongoing positive macroeconomic conditions are likely to be the primary driver of price action in the coming months.

Bitcoin Sellers to See Massive Liquidations if Price Persists to $70,500

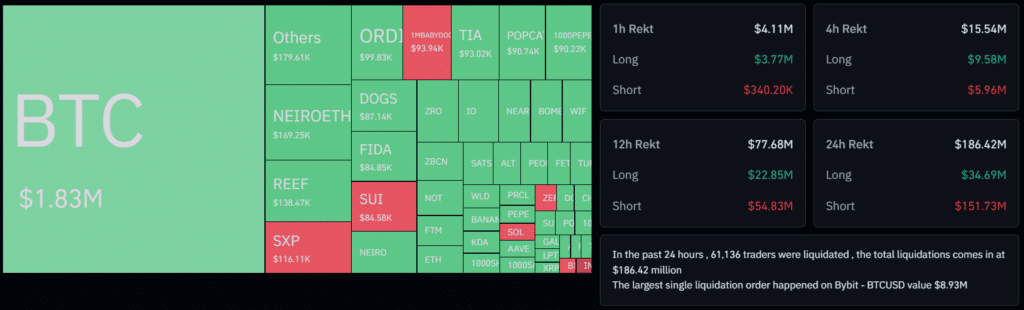

The recent price surge has also had a significant impact on the cryptocurrency derivatives market. Data from Coinglass reveals that over $186 million worth of leveraged short positions have been liquidated in the past 24 hours, indicating a strong bullish sentiment among traders.

As Bitcoin continues to gain momentum, market participants are keeping a close eye on key resistance levels. A breakthrough above $70,500 could potentially trigger a massive short squeeze, with some analysts suggesting that over $21 billion in short positions could be liquidated if this level is breached.

Liquidation Heatmap showing $21.77b shorts to be liquidated at $70476 on @binance pic.twitter.com/VCX7t2NIdz

— MartyParty (@martypartymusic) September 19, 2024

With the cryptocurrency market showing renewed vigor and institutional interest on the rise, many industry observers believe that Bitcoin may be on the cusp of another major bull run. However, as always in the volatile world of cryptocurrencies, investors are advised to exercise caution and conduct thorough research before making investment decisions.

Interested In Trading The Market With A Trustworthy Partner? Try LonghornFX Today.

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.