Bitcoin jumped more than 9% to reach $83,583 on Wednesday after U.S. President Donald Trump announced a 90-day pause on most tariffs. This market recovery follows a difficult period when Bitcoin traded below $75,000 just a few days ago.

The pause lowered reciprocal duties to 10% for most countries while raising tariffs on China to 125%. The news triggered massive rallies across financial markets, with the tech-heavy Nasdaq recording its biggest single-day gain since January 2001, surging 12.16%.

Crypto-related stocks also made significant gains, with Coinbase rising 16.91% and Strategy (formerly MicroStrategy) jumping 24.76%.

Cardano Founder Predicts BTC Will Hit $250,000

Despite this positive movement, Charles Hoskinson, founder of the Cardano blockchain and co-founder of Ethereum, has made an even bolder prediction. In an interview with CNBC’s “Beyond The Valley” podcast, Hoskinson claimed Bitcoin could reach $250,000 “by the end of this year or next year.”

Hoskinson explained several factors could drive this massive price increase:

1. Growing user adoption: Crypto.com reports cryptocurrency owners rose 13% in 2024 to 659 million people worldwide.

2. Changing global politics: Hoskinson believes the shift from “rules-based international order to a great powers conflict” makes cryptocurrency the “only option for globalization.”

3. New legislation: Upcoming stablecoin legislation and the Digital Asset Market Structure and Investor Protection Act could provide regulatory clarity.

4. Tech giants entering crypto: Hoskinson predicts the “Magnificent 7” technology companies (including Apple, Microsoft, and Amazon) will begin using stablecoins for international payments once key legislation passes.

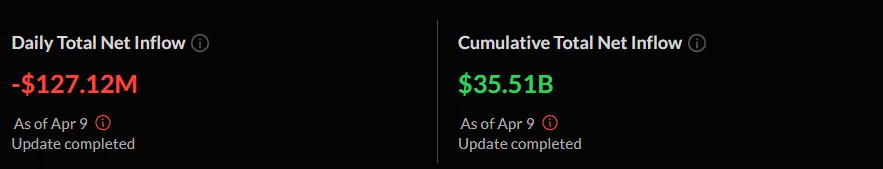

Bitcoin ETFs See Outflows Despite Market Rally

Interestingly, U.S. spot Bitcoin exchange-traded funds (ETFs) recorded net outflows of $127.12 million on Wednesday despite the market rally, extending their streak of negative flows to five consecutive days.

BlackRock’s IBIT recorded the largest outflows at $89.71 million, followed by Grayscale’s GBTC with $33.8 million leaving the product. VanEck’s and WisdomTree’s ETFs also saw money leaving their funds.

Bitwise’s BITB was the only spot Bitcoin ETF to report inflows, with $6.71 million flowing into the fund on Wednesday.

Jeff Mei, COO of crypto exchange BTSE, explained to The Block, “The market is rallying in response to anticipation that most trading partners will negotiate trade deals with the U.S., avoiding a full-fledged trade war.” However, he noted traders remain cautious about ongoing trade tensions between the U.S. and China.

According to Hoskinson, the crypto market may “stall for probably the next three to five months” before seeing “a huge wave of speculative interest” around August or September that could last another 6-12 months.

Interested In Trading The Market With A Trustworthy Partner? Try Eightcap Today.

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.