On Friday, the benchmark cryptocurrency dropped as low as $11,200 (previous resistance turned support), before jumping back to the $11,600s level, which is where we’re currently trading at.

Meanwhile, worth mentioning is the effect that Bitcoin derivatives (futures and options) are likely to have on the price action of the cryptocurrency in the near-term. Analysts have pointed out that the funding rate of Bitcoin futures is currently neutral after last week’s positive momentum.

This means that neither longs nor shorts are “over-leveraged.” Usually, neutral funding rates are seen before Bitcoin experiences a leg up.

Key Levels To Watch

History has shown that a parabolic run (a bull-run without corrections) almost always ends badly. A good example is the 2017 bull-run.

Friday’s decline was a healthy correction to the recent bullish trend. The intense dip-buying that was noted after the drop showed just how strong the market was.

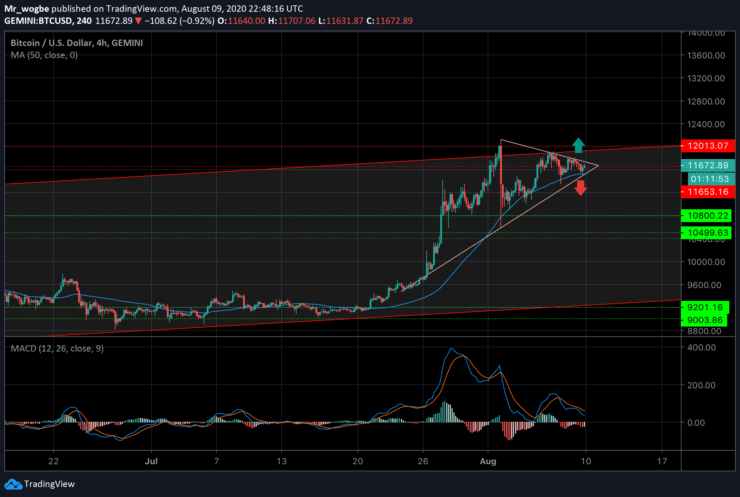

On the 4-hour chart, we can see that BTC is forming a rising wedge, which could be a key determinant in the next surge. An upwards breakout above the $11,800 would favor the bulls while a break below the $11,400 level could turn BTC bearish in the short-term. However, a fall from this level will be strongly supported by the 50 HMA ($11,530).

Meanwhile, the path of least resistance remains strongly to the upside as our focus remains on $12,000).

Total Market Cap: $357.3 billion

Bitcoin Market Cap: $215.8 billion

BTC Dominance Index: 60.2%

Note: Learn2.trade is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.