• The short-term bearish correction remains valid while Bitcoin consolidates

Over the past 24-hours, the entire crypto market saw a small recovery but now back on a bearish mode. Though Bitcoin has been quite stable at around $8800; following a sharp bounce from $8600. While attempting to reclaim $9000 yesterday, Bitcoin got rejected and now trading around $8700 at the moment as sellers show more interest.

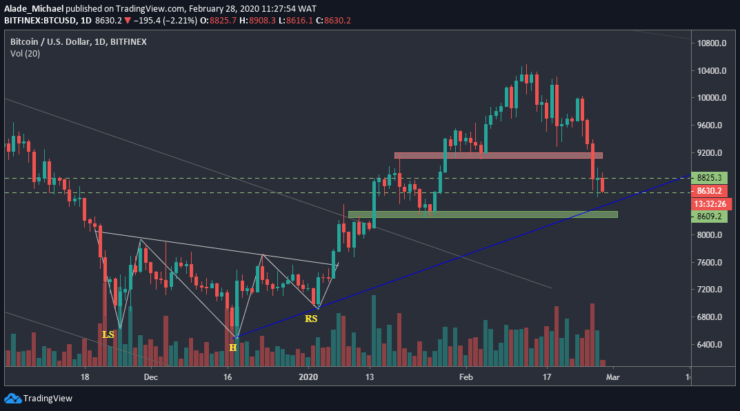

Key resistance levels: $8800, $8900, $9000

Key support levels: $8600, $8500, $8400

Bitcoin (BTC) Price Analysis: Daily – Bearish

Yesterday, Bitcoin touched $8600 with a long wick after witnessing a two weeks decline. Bouncing off this mentioned weekly low, Bitcoin recovered a bit near $9000 before closing around $8800 with a bullish doji.

Bitcoin is facing $8600 support again. If this support fails to hold, price drop into a key support area of $8400 – marked green on the daily chart. If BTC respects this demand zone along with the blue rising trend line, a quick bounce should send the price back to $10000 resistance in no time. For now, the closest resistance for Bitcoin is $9000

Bitcoin (BTC) Price Analysis: 4H Chart – Bearish

On the 4-hours, Bitcoin has been in the middle of consolidation for the past few hours now. While the $9000 resistance is proving difficult for the bulls to overcome on the upside, the $8600 has continued to suppress bearish actions for a while now.

However, it may break if the current bearish sentiment intensifies. In view of this, $8500 and $8400 supports may be explored. In case the bulls show a strong interest, Bitcoin is likely to regain momentum to $8900 and $9000 resistance before showing further direction. Nonetheless, BTC behaviour is still bearish at the moment.

BITCOIN SELL ORDER

Sell: $8620

TP: $8500

SL: $8800

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.