• The only condition for a bullish continuation is if Bitcoin can increase well above $7000

After struggling to stay above $6900, Bitcoin turned weak and saw a 10% drops during the weekend. This price drops led to a slight break below $6000 level and brought a weekly close around $5880. Following this week opening, Bitcoin has bounced back and now trade around $6295.

Key resistance levels: $6500, $6900, $8000

Key support levels: $6000, $5677, $5200

Bitcoin (BTC) Price Analysis: Weekly Chart – Bearish

Since the Early March crash, Bitcoin is still struggling to recover back as the price remains trapped inside a symmetrical triangle on the weekly chart. As we can see, Bitcoin wicked twice at $6900 to show that there’s a strong resistance around this mentioned price levels. Though, the bulls are starting to regroup again towards this resistance.

Notwithstanding, Bitcoin is still considered bearish on the weekly. The buyers need to push above the $6900 resistance before we can consider a bullish move to $8000, around the triangle’s resistance. Considering the bearish sign (last week’s pin bar), Bitcoin is likely to roll back to $5200 if $6000 support breaks again.

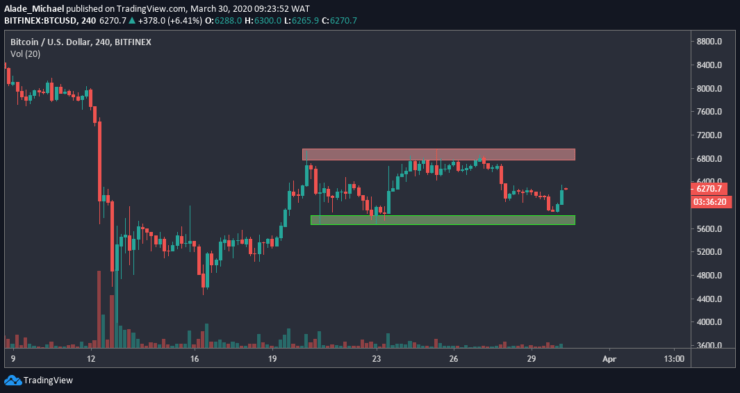

Bitcoin (BTC) Price Analysis: 4-Hours Chart – Neutral

In the 4-hours chart, Bitcoin appeared to be forming a range, considering the latest recovery from $5880. As we can see, Bitcoin is charging again at a strong supply zone, marked red on the chart. Meanwhile, there’s a small resistance at $6500, which is likely to suppress the ongoing buy actions.

In case Bitcoin overcomes this resistance to reach the supply zone, a breakout could send a strong buy to $7600 or even $8000. However, if Bitcoin resume selling, the first support here is $5880 (today’s opening price), followed by the green demand area of $5677. A dip below this support could cause huge selloff to $5200. As of now, Bitcoin is showing a sign of recovery while it remains sideways.

BITCOIN BUY ORDER

Buy: $6295

TP: $6480

SL: $5980

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.