• BTC remains bullish but sellers lurk around.

• A break below $8500 may set the market on correction mode.

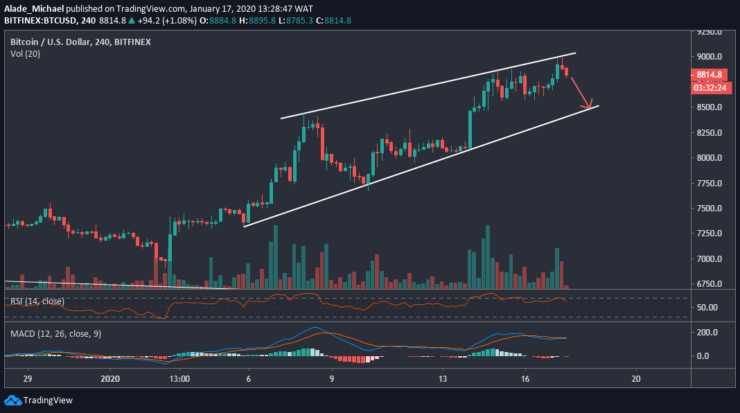

Again, Bitcoin’s price has increased by roughly 5% to hit $9000 after breaking from the strong bearish zone of $8400 this week. This surge has made BTC reach the wedge resistance on the 4-hours chart. A downward correction is clearly playing out on the hourly channel pattern. Once Bitcoin clearly breaks below $8500, we should expect a short-term sell to $8000. Still, Bitcoin remains bullish!

Key resistance levels: $9000, $9400

Key support levels: $8600, $8500

Bitcoin (BTC) Price Analysis: 4H Chart – Bullish

Bitcoin has made an upward shift the wedge’s resistance at $9000 a few hours ago. The buyers are still showing interest in the BTC price. Considering the last 4-hours rejection candle that led the bulls to $9000 earlier today, Bitcoin’s price is likely to correct to the wedge’s support of $8500 in the next few hours.

A drive below this wedge might cause a lot of bearish sentiment. A rebound from this wedge’s support could send Bitcoin straight to $9400 resistance in the next rally. But looking at the price action, the BTC market is due for a correction. A small bearish play is around the corner. Nevertheless, the technical indicators are still up. So, we can expect bullish continuation once Bitcoin run a retracement.

Bitcoin (BTC) Price Analysis: Hourly Chart – Bullish

So far, the $8400 breakout has allowed Bitcoin trade in a channel boundary with a mild gain to $9000. Now, the price is dropping toward the channel’s support. It may lead to a devastating drop if $8600 fails to provide support for the BTC market. A break could floor Bitcoin at $8400 and $8200.

Bouncing off this channel could allow buyers to retest $8800 and $9000 resistance once more. As shown on the RSI, the price of Bitcoin is currently dropping, although now sitting on the 50 level. The MACD moving average is currently aiming a bearish cross. If these indicators drop below their mid-levels, BTC would confirm a bearish correction to key supports. However, the bullish bias remains valid at the moment.

BITCOIN SELL SIGNAL

Sell Entry: $8814

TP: $8514

SL: $9050

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.