• If Bitcoin fails to rebound at this support, a slight bearish correction is likely for Bitcoin

Since yesterday, Bitcoin’s bullish sentiment paused after facing resistance at $10450. This rejection has led to about 3% losses; bringing the current price to $10100. Due to this, BTC dominance dropped to 61.7%. The rally could resume if Bitcoin can hold above $10000 support. Otherwise, a mild bearish sentiment may flow into the market for a while before a recovery.

Key resistance levels: $10280, $10450, $10600

Key support levels: $10000, $9700, $9200

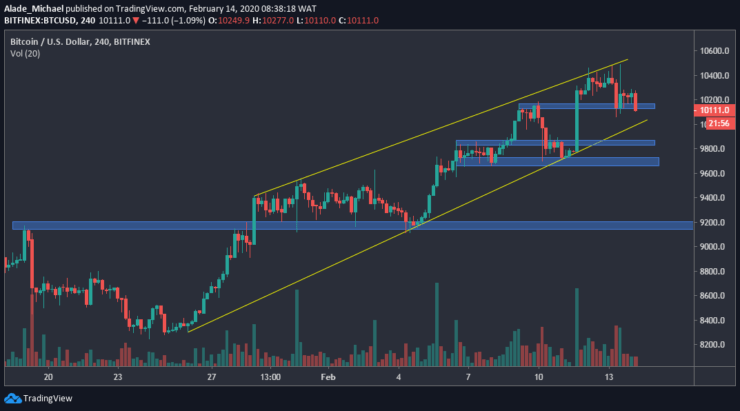

Bitcoin (BTC) Price Analysis: 4H Chart – Bullish

Bitcoin is still looking bullish on the 4-hours chart, although the price is now close to the wedge’s lower boundary, around $10000. Any time from now, we should expect a huge price movement. Considering this pattern, a bearish correction could be underway. Notwithstanding, Bitcoin’s resistance is located at $10280 and $10450. Rising above these resistances could allow fresh high at $10600.

Anyways, Bitcoin’s bullish sentiment is valid but fading at the moment. A drive below the wedge’s support could cause a heavy sell for BTC. There are lots of supports here but the key area to look out for is $9700. If BTC continues to drop, the next major support is $9200 – the blue area. Even though Bitcoin drops to these mentioned supports the long-term bullish would remain valid.

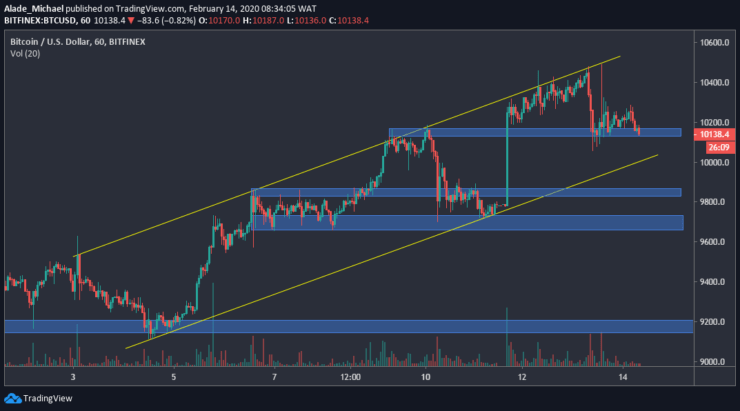

Bitcoin (BTC) Price Analysis: Hourly Chart – Bullish

A 24-hours retracement has brought Bitcoin’s price near important support of $10000 but the market is hovering around a key price level of $10100 at the moment. Meanwhile, the bullish sentiment remains valid in a rising channel. Currently, Bitcoin is giving a discount as we can expect a bounce-back soon.

If Bitcoin rebound at the current blue support area or around the channel’s support, the next resistance to watch is $10200 and $10400. If Bitcoin drops below this rising channel, however, we should expect a big drop to $9900 and $9700 support in the blue areas on the hourly chart. At the moment, we may need to wait for a break or bounce on the channel before entry.

BITCOIN BUY ORDER

Buy: $10055

TP: $10300

SL: $9911

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.