Many analysts now believe that a highly bullish pattern is emerging, which could have a major influence in the near-term.

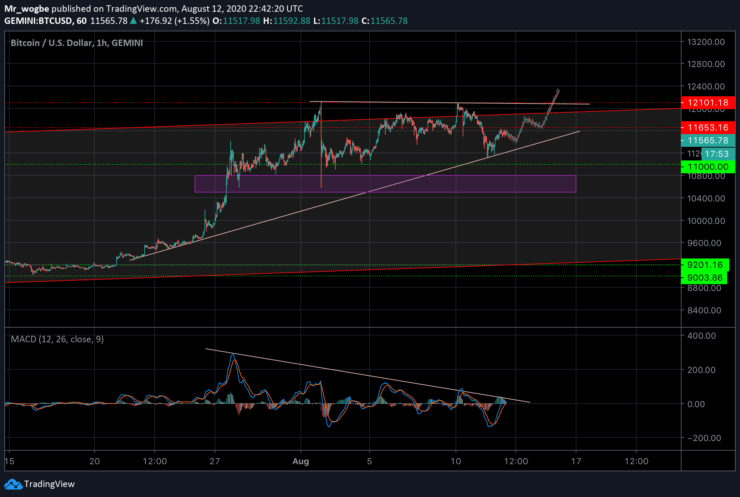

The ascending triangle, which we pointed out in some days ago, has been forming for a few weeks now and the upper and lower boundaries have been tested several times.

A validation of this pattern could help the benchmark cryptocurrency print some significant gains in the coming week once it can successfully defeat the $12k mark.

Also, this pattern has emerged at a time when Bitcoin is showing some signs of growing strength after its bounce from the $11,200 support. The combination of this pattern with a positive market sentiment indicates that a breakout rally is imminent.

Key Levels To Watch

At press time, Bitcoin is trading up by about 2% at its current price of $11,576. The cryptocurrency has been oscillating between the $11,500 and $11,600 since its overnight rebound.

Yesterday’s selloff led BTC to drop as far as $11,150, before getting rescued by a strong influx of bull trades. The sharp decline almost reversed the bullish strength the cryptocurrency has been building assiduously for weeks now.

Nonetheless, analysts expect a strong surge to the upside in the near-term, explaining that BTC remains significantly bullish above $11,500

That said, key resistance levels include $11,650, $12,000, and $12,100. While support can be found at $11,150, $11,000, and $10,800.

Total Market Cap: $357.3 billion

Bitcoin Market Cap: $213 billion

BTC Dominance Index: 59.6%

Note: Learn2.trade is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.