As the U.S. presidential election approaches, Bitcoin is making waves in the financial world. Experts predict the world’s largest cryptocurrency will reach new record prices by the end of 2024, regardless of who wins the White House.

Standard Chartered, a major investment bank, recently shared some exciting forecasts. They believe Bitcoin could soar to $125,000 if Trump wins or hit $75,000 if Harris becomes president. Either way, that’s a big jump from its current price of around $58,000.

JUST IN: A Trump victory could send #Bitcoin to $125,000, but new ATHs are likely no matter who wins election, says Standard Chartered bank 🚀 pic.twitter.com/SfGoRSyKwn

— Bitcoin Magazine (@BitcoinMagazine) September 12, 2024

Why the optimism? Experts point to several positive factors.

For one, there’s progress in relaxing regulations. This includes possibly getting rid of a rule called SAB 121, which makes it hard for banks to hold digital assets. These changes are expected to continue no matter who’s in charge, though they might happen slower under Harris.

Another boost could come from changes in U.S. Treasury rates. As the difference between short-term and long-term rates grows, it tends to create good momentum for Bitcoin.

Bitcoin Miners Come Under Pressure as Bitcoin Difficulty Soars

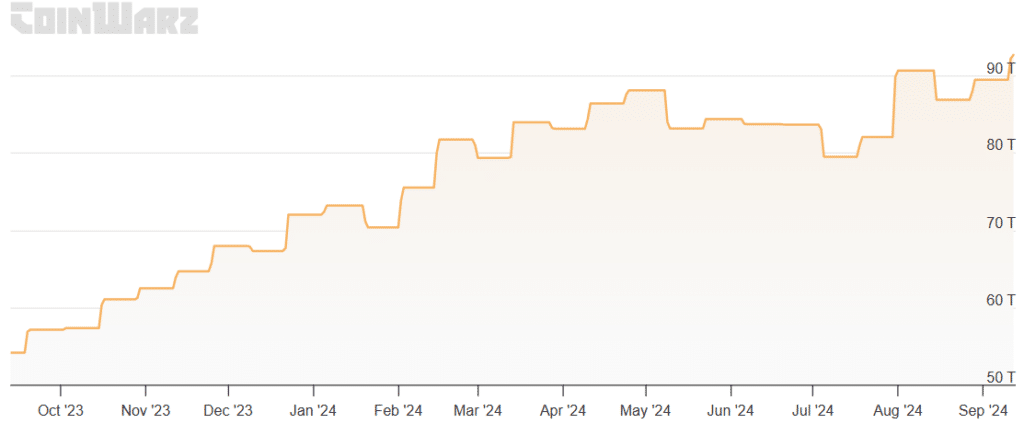

But it’s not all smooth sailing for the crypto world. Bitcoin mining, the process of creating new coins, is getting tougher. The “mining difficulty” just hit an all-time high of 92.67 terahashes. This means miners need more computing power than ever to earn new Bitcoins.

Higher difficulty can squeeze miners’ profits because it costs more to run their operations. Some worry this might force miners to sell more Bitcoin to cover expenses, potentially affecting prices.

However, relief may be on the horizon. The next “difficulty adjustment” is expected to happen on September 27, and it might actually make mining easier. This could help take some pressure off miners.

Experts are split on how these mining challenges will affect Bitcoin’s price. Some say there’s no clear link between mining difficulty and price. Others warn that if the overall financial markets weaken, we might see more selling pressure on Bitcoin.

Despite these challenges, the outlook for Bitcoin remains positive. The cryptocurrency continues to attract attention from investors and institutions alike. As regulations become clearer and more favorable, many expect Bitcoin to play an even bigger role in the financial world.

For those interested in crypto, keeping an eye on both the election results and mining trends will be crucial in the coming months. These factors could significantly shape Bitcoin’s performance as we head into 2025.

Make money without lifting your fingers: Start using a world-class auto trading solution

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.