Recent on-chain data reveals a sharp increase in Bitcoin miner outflows, indicating that selling from this group may be to blame for the cryptocurrency’s recent slide to $20,400.

According to an analyst’s post on CryptoQuant, miners deposited 669 BTC to exchanges on Wednesday. The “miner reserve,” which reflects the total amount of Bitcoin that miners as a group are currently holding in their wallets, is an important indicator in this case.

The amount of coins that these blockchain validators are now moving out of the miner reserve is indicated by the statistic known as “miner outflow.” Here’s how it works: if an equal or greater amount of the cryptocurrency does not flow inside at the same time as the outflow spikes, the reserve’s value will inevitably decrease.

Typically, miners withdraw Bitcoin from their reserve to sell. Therefore, anytime the outflow records high values (or the reserve records a sharp drop), it suggests that this group may be actively selling significant chunks of their holdings at that time.

In the past few days, the outflow of Bitcoin miners has recorded two substantial surges. On January 14, the metric’s increase was around 4,089 BTC, and on January 17, it was approximately 2,500 BTC.

Their reserves also decreased at the same time as these withdrawals, so there wasn’t sufficient incoming volume to make up for these outflows. That said, a third spike appeared on Wednesday but was much smaller than the other two.

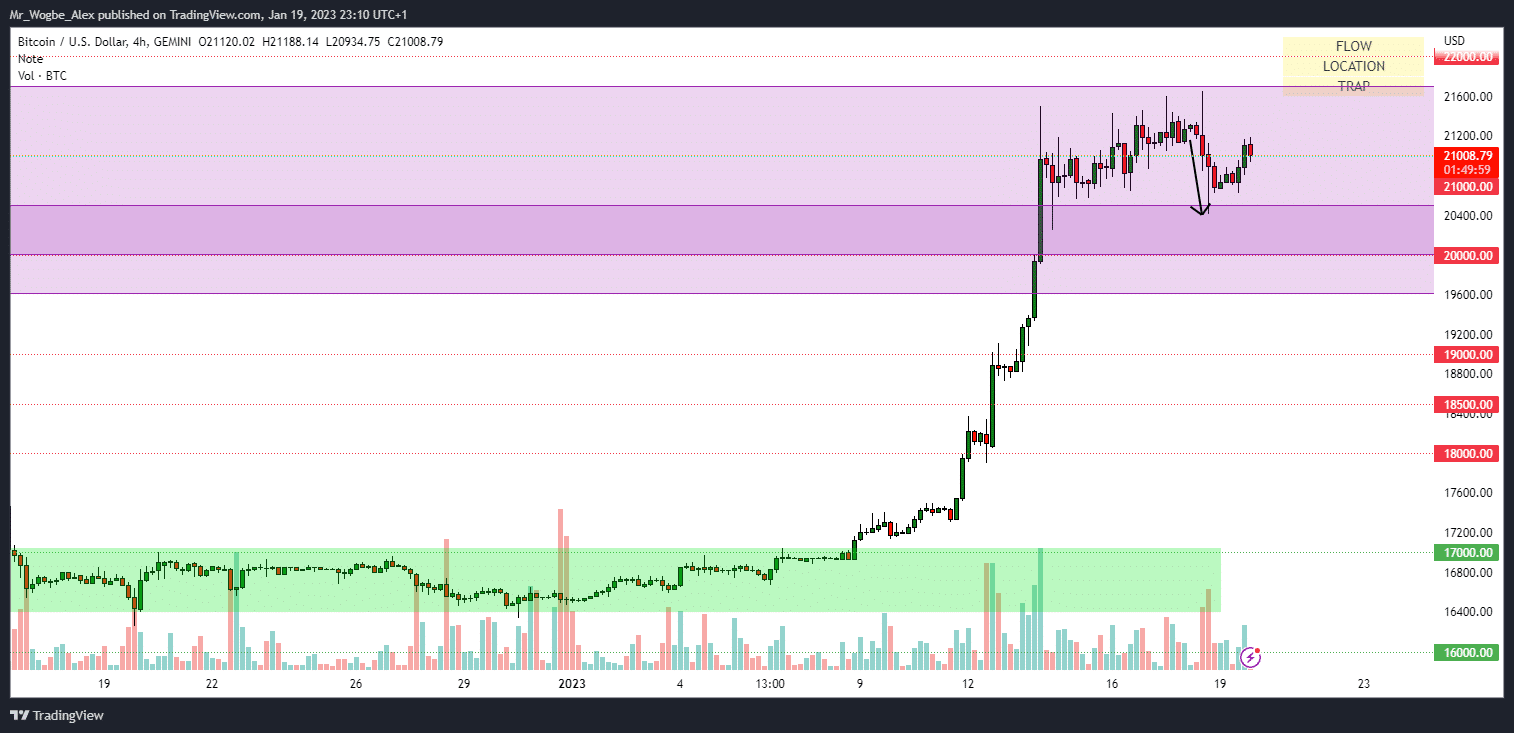

Bitcoin Miner Outflow Responsible for the Fall to $20,400

That said, when the first two outflow transactions occurred, the Bitcoin rally recorded a slowdown. However, it is believed that the third transaction dealt the finishing blow, as the trend of the cryptocurrency immediately turned bearish once it was recorded, sending the benchmark cryptocurrency to the $20,700 area.

You can purchase Lucky Block – Guide, Tips & Insights | Learn 2 Trade here. Buy LBLOCK

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.