Hong Kong, renowned as a global financial hub, is gearing up to make a significant stride in the digital assets sector. Reports suggest that the city is on the brink of endorsing exchange-traded funds (ETFs) directly linked to Bitcoin and Ethereum. This development is anticipated to breathe new life into the crypto market, particularly in light of the upcoming Bitcoin halving event.

Regulatory Green Light Expected Imminently

Insiders familiar with the situation have hinted that regulatory approval for these crypto ETFs could materialize as early as Monday (April 15).

Hong Kong may approve Spot ETF that invest directly in Bitcoin and Ethereum as early as Monday (April 15), according to Bloomberg. Unlike in the United States, Hong Kong’s cryptocurrency ETFs can support physical redemptions.https://t.co/vCDGPF3x5b

— Wu Blockchain (@WuBlockchain) April 12, 2024

Among the anticipated issuers are international branches of major Chinese asset managers, including Harvest Fund Management Co. and Bosera Asset Management (International) Co., in collaboration with HashKey Capital.

These entities have patiently awaited the nod from the Securities and Futures Commission (SFC) to kickstart spot-crypto ETFs. Their plans entail initiating trading by the month’s end. However, specific listing details are still pending with Hong Kong Exchanges & Clearing Ltd. (HKEX).

The US Securities and Exchange Commission (SEC) set the stage for the digital asset industry by greenlighting the trading of spot Bitcoin ETFs in January 2024. Since receiving regulatory approval, Bitcoin (BTC) has witnessed remarkable gains, soaring by 60% year-to-date. Presently, BTC is trading at an impressive $67,700.

Bitcoin Halving Is Not Yet Priced In: Analyst

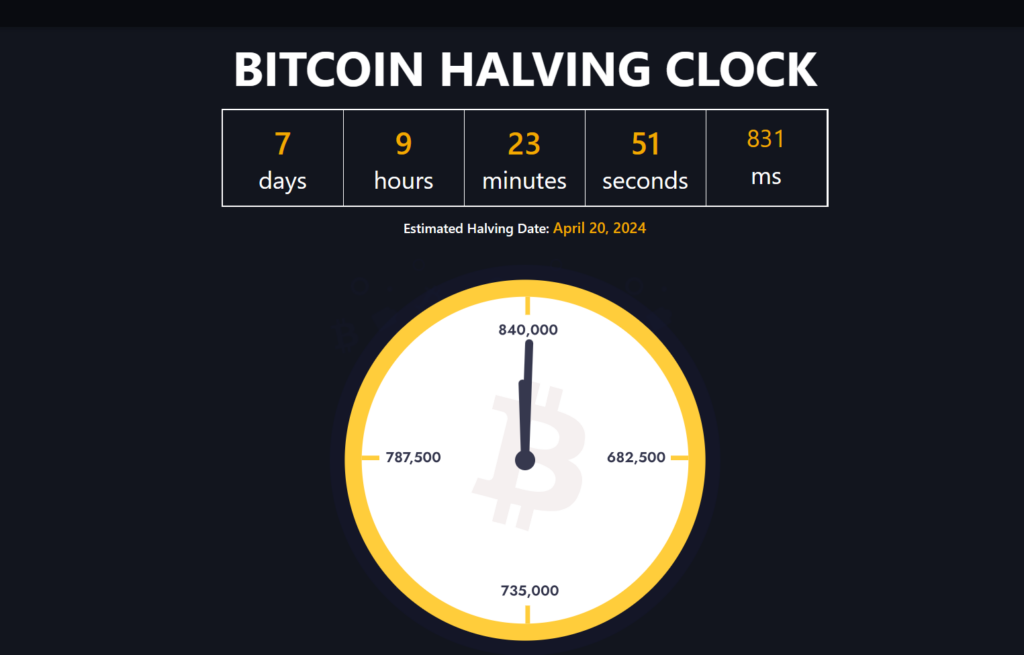

In related developments, the imminent Bitcoin halving remains a hot topic of discussion. Set for April 20, some analysts argue that the effect of this event has yet to be fully factored into the market.

The halving event, which reduces the block reward for miners, is anticipated to bring about tangible changes to the digital asset’s supply and demand dynamics.

Matt Ballensweig, Head of Go Network at BitGo, shared his insights on the matter with The Block. He stressed that digital asset investors and traders are consistently pondering whether the halving has already been priced in.

Historically, each cycle has demonstrated that the halving tends to catch the market off guard. Similarly, despite initial assumptions, the approval of the spot Bitcoin ETF did not diminish enthusiasm. In fact, during the first 60 days of ETF trading, the Bitcoin price experienced a significant rally.

Want reliable crypto signals to capitalize on market swings? Join us on Telegram.

Interested In Getting The “Learn2Trade Experience?”Join Us Here

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.