In a remarkable display of investor confidence, the crypto market has witnessed an unbroken six-week streak of crypto inflows, totaling an astounding $767 million, according to the latest weekly report from CoinShares. This surge surpasses the entirety of inflows seen in the entirety of 2022, making it the most extended streak since the end of the bull market in December 2021.

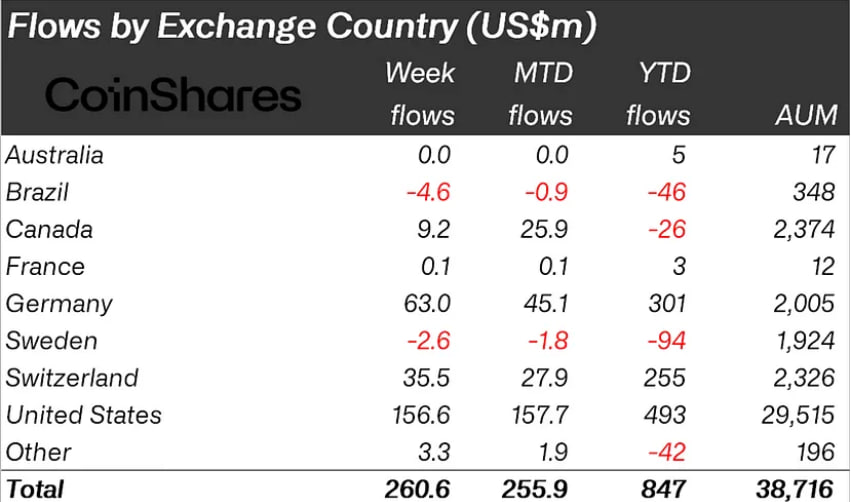

Leading the charge in this crypto adoption wave is the United States, with investors injecting a substantial $157 million into digital assets. Following closely behind, Germany, Switzerland, and Canada contributed $63 million, $36 million, and $9 million, respectively.

This heightened interest can be attributed to two key factors: the mounting probability of a spot-based Bitcoin ETF in the U.S. and concerns over the effectiveness of U.S. monetary policy, amplified by weaker-than-expected macroeconomic data.

Bitcoin Guzzles Lion’s Share of Crypto Inflows

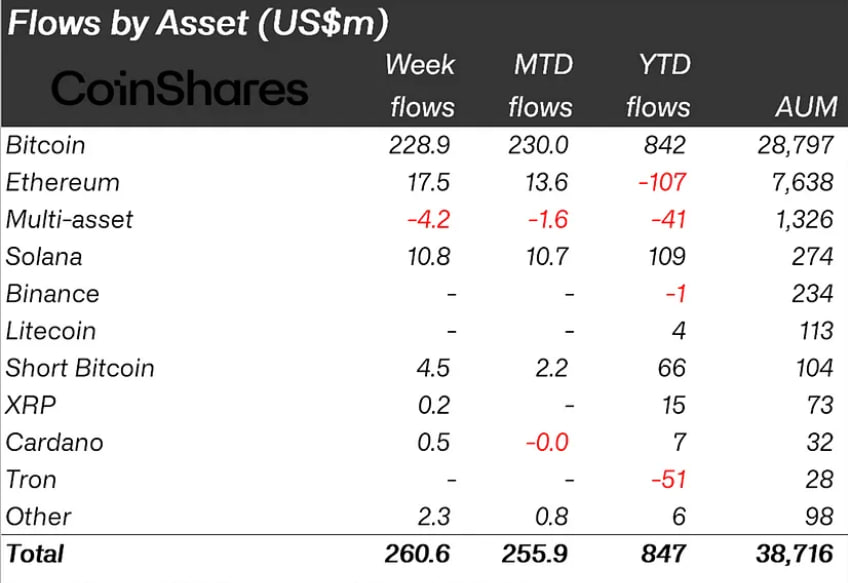

Bitcoin, the poster child of cryptocurrencies, remains firmly in the spotlight with $229 million in inflows, taking its year-to-date total to a staggering $842 million. However, not all investors are bullish on Bitcoin, as short-Bitcoin products saw inflows of $4.5 million, signaling a divergence of opinion on the sustainability of its recent rally, albeit largely inconsequential.

Ethereum, while facing a series of outflows throughout the year, saw a substantial reversal with inflows of $17.5 million, the highest since August 2022.

Altcoins See Notable Inflows Too

Diversification is the name of the game, with other altcoins such as Solana, Chainlink, Polygon, and Cardano receiving notable inflows of $11 million, $2 million, $0.8 million, and $0.5 million, respectively. These inflows now constitute 17% of the total assets under management for these altcoins, reflecting a growing appetite among investors to explore fresh opportunities in the crypto space.

Despite lingering regulatory uncertainty and market volatility, the crypto market continues to demonstrate maturity and resilience. The ongoing influx of funds into digital assets underscores the growing acceptance and enthusiasm of investors in the ever-evolving world of cryptocurrencies.

At the time of this report, Bitcoin was trading flat at $35,000 as the market gears up for the continuation of the recent bullish craze to sweep the market.

Try Out Our Trading Bot Services Today. Get Started Here

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.