Bitcoin experienced a sharp pullback in early October 2025, dropping from its all-time high above $125,000 to around $105,000 in just four days.

According to VanEck’s latest analysis, this 18% correction reflects a necessary reset in market conditions rather than the beginning of a prolonged downturn.

The sell-off was triggered by a combination of factors, including:

- Escalating U.S.-China trade tension

- Excessive leverage in futures markets

- Large holders taking profits

This created a cascade effect where margin calls forced traders to liquidate positions rapidly. However, with futures leverage now sitting at the 61st percentile of historical ranges—down from the 95th percentile before the crash—the market appears to be stabilizing.

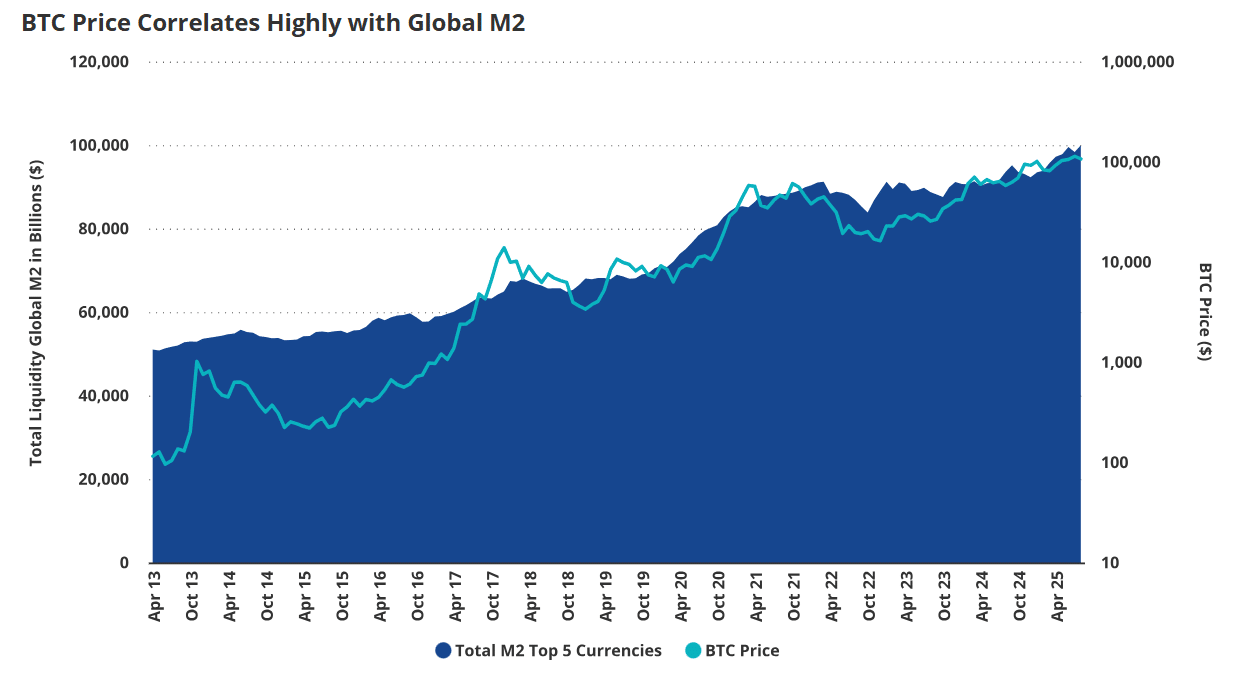

Global Liquidity Remains Bitcoin’s Primary Driver

VanEck’s research confirms that global money supply growth continues to explain more than half of Bitcoin’s price movements over time. Since 2014, Bitcoin has maintained a 0.5 correlation with global M2 expansion, reinforcing its role as a hedge against currency debasement.

An interesting shift has occurred in price discovery patterns. Asian trading hours now lead global Bitcoin returns, a reversal from earlier cycles when Western markets dominated.

This change may signal tightening liquidity in Asian markets as central banks in India and China prioritize currency defense over domestic money growth.

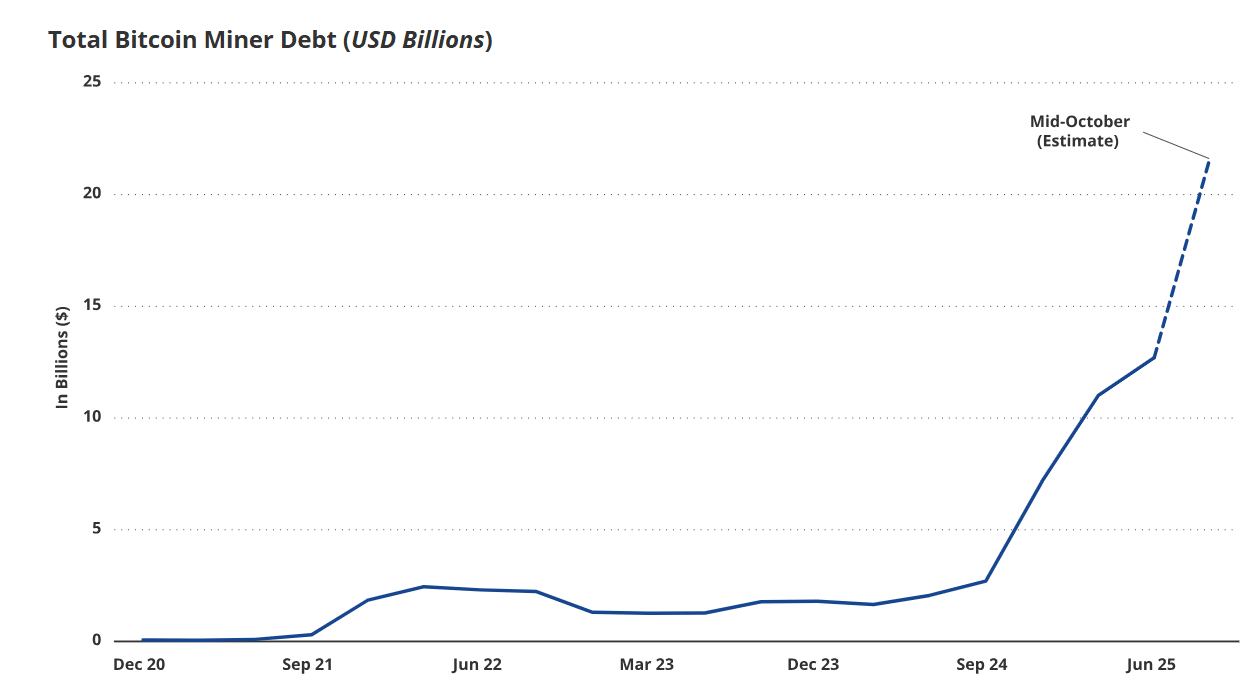

Bitcoin Mining Industry Transforms Through AI Pivot

Bitcoin miners have dramatically increased their debt levels—from $2.1 billion in Q2 2024 to $12.7 billion in Q2 2025, according to VanEck.

This surge reflects a strategic pivot toward AI and high-performance computing data centers, which offer more predictable cash flows through multi-year contracts.

Rather than threatening Bitcoin’s network security, this shift could strengthen it. Miners can now monetize excess electricity during periods of low AI demand, creating a symbiotic relationship between Bitcoin mining and AI infrastructure.

Investment Implications

With Bitcoin representing roughly 2% of the global money supply, VanEck suggests that holding less than this percentage in a portfolio may constitute an implicit bet against the asset class.

Their model portfolios currently allocate between 1.47% and 6.08% to digital assets, reflecting confidence in Bitcoin’s long-term trajectory despite near-term volatility.

The current correction, combined with normalized leverage levels and Bitcoin trading near one-year lows relative to gold, presents what VanEck views as a buying opportunity for investors with appropriate risk tolerance.

Interested In Trading The Market With A Trustworthy Partner? Try Eightcap Today.

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.