Bitcoin started December 2025 on a calmer note, but the rest of the second half of the year has shown a clear split between Bitcoin and the stock market.

While stocks gained strength after a series of U.S. Federal Reserve rate cuts, Bitcoin struggled to hold momentum, creating one of the widest gaps between the asset and major equity indexes this year.

Why Bitcoin’s Trend Shifted in Late 2025

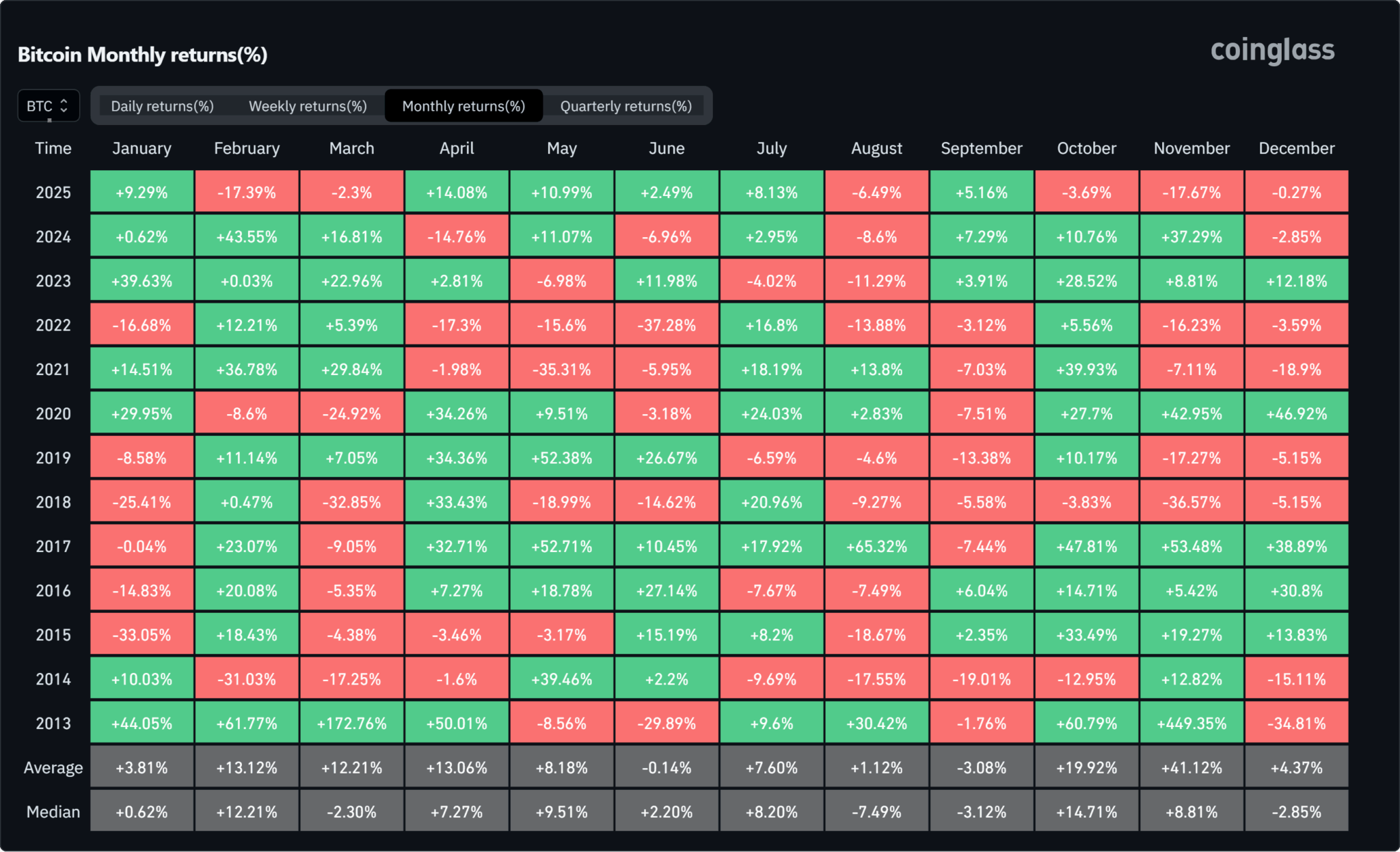

For most of Q3, Bitcoin moved in step with stocks. That changed as Q4 began. Stocks rallied on strong earnings and optimism around monetary easing, but Bitcoin fell almost 18% over the last six months.

In the same period, the Nasdaq climbed 21%, the S&P 500 rose more than 14%, and the Dow added over 12%. Several events played a role in this break.

July brought renewed confidence after the GENIUS Act became law, lifting crypto enthusiasm and pushing Bitcoin up more than 8% for the month.

August saw Bitcoin hit a new high near $124,000, but it could not hold the rally, finishing the month down as rate-cut expectations shifted.

September was unusually strong for Bitcoin, ending with a 5% gain after the Fed made its first rate cut of 2025.

October, however, marked a turning point. A record liquidation wave of about $19 billion, sparked by a mix of leverage, a Binance price glitch, and trade tensions following President Trump’s tariff threat, sent Bitcoin below $110,000.

What This Means for Bitcoin Traders

Bitcoin’s pattern in late 2025 highlights how quickly sentiment can shift when leverage, policy changes, and geopolitical stress collide. Traders who rely on correlations with the stock market may need to adjust their strategies.

The data shows that Bitcoin can break away from equities even when both respond to the same macro trends.

With December historically mixed for Bitcoin and major banks cutting their year-end targets—Standard Chartered lowered its forecast from $200,000 to $100,000—market participants should stay alert and avoid assuming the asset will follow stock market strength.

Interested In Trading The Market With A Trustworthy Partner? Try Eightcap Today.

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.