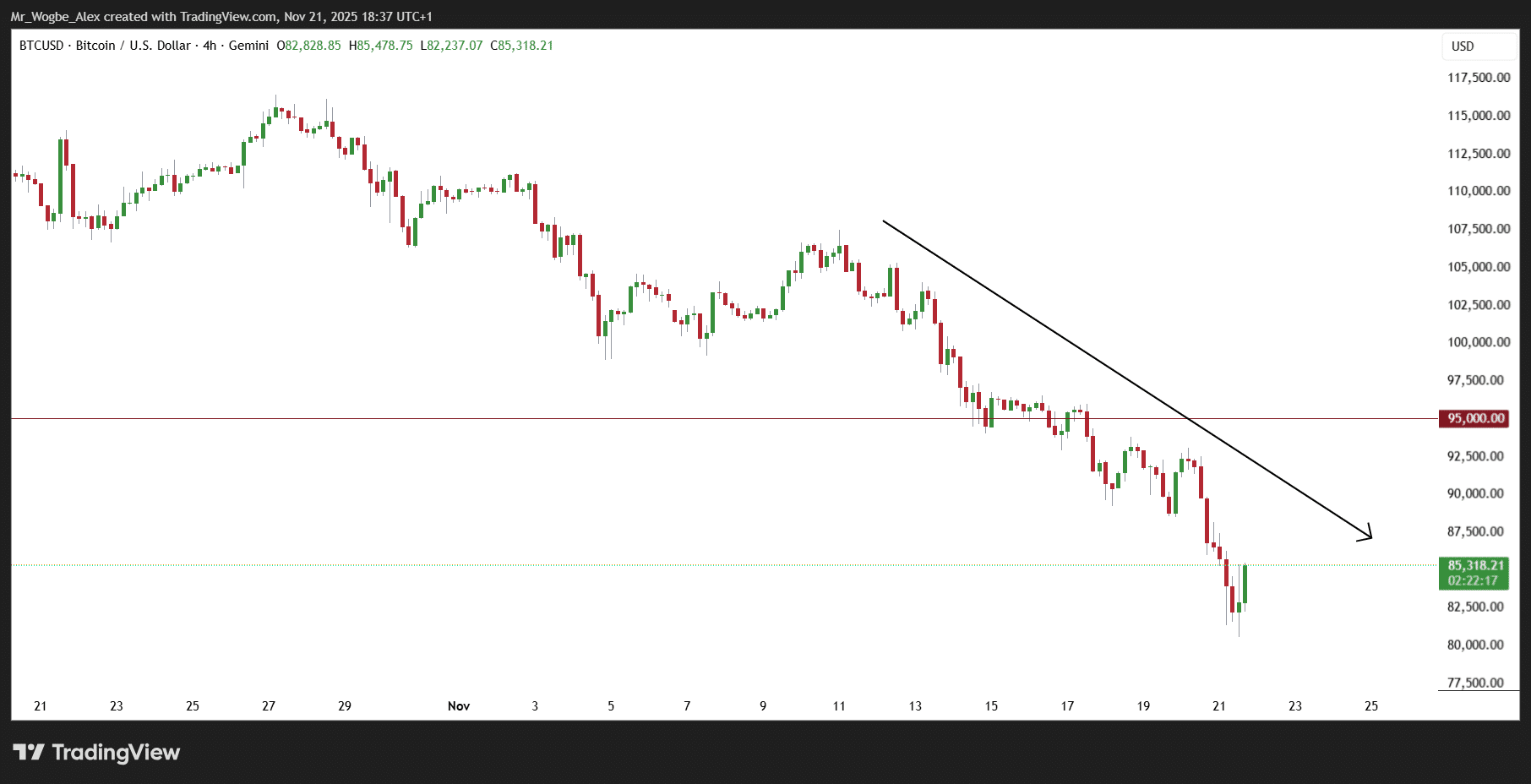

Bitcoin dropped below $81,000 on Friday on the back of stronger-than-expected U.S. jobs data that reduced the chances of a December interest rate cut.

BTC fell 7.4% to $80,550 within 24 hours, hitting its lowest point in seven months. This marks a steep 36% decline from its October peak of $126,320.

The surprise came from September’s delayed jobs report, which showed the U.S. economy added 119,000 jobs — more than double the expected 50,000.

These numbers suggest inflation remains a concern, making it less likely the Federal Reserve will cut rates next month. According to the CME FedWatch Tool, there’s now only a 35.4% chance of a December rate cut.

Bitcoin and Crypto Market Sentiment Hits Rock Bottom

The Crypto Fear & Greed Index dropped to 11, signaling “extreme fear” among investors. The entire crypto market lost 6.62% of its value in one day, with total market cap falling below $3 trillion for the first time since May.

Vincent Liu from Kronos Research explained that thin liquidity and short-term profit-taking made the drop worse. “The market is recalibrating risk, reacting to macro data points,” he said.

Liu added that a single rate cut won’t be enough to push prices back to October levels. The market needs fresh capital flows and stronger on-chain demand for a real recovery.

Nearly $2 Billion in Liquidations

The sell-off triggered massive liquidations across crypto markets. Almost $2 billion in leveraged positions were wiped out, affecting over 363,700 traders. The largest single liquidation was a $36.78 million Bitcoin position on Hyperliquid.

Bitcoin ETFs also saw heavy outflows, with $903 million leaving these funds on Thursday alone — the second-largest outflow since their launch. This institutional selling added more pressure to already weak markets.

Some analysts believe Bitcoin could fall further to key support levels around $81,900 or even $73,000-$78,000 before finding a bottom. However, LVRG Research’s Nick Ruck sees this as a “healthy repricing” after last month’s rally, with on-chain data showing signs that capitulation may be nearing its end.

Interested In Trading The Market With A Trustworthy Partner? Try Eightcap Today.

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.