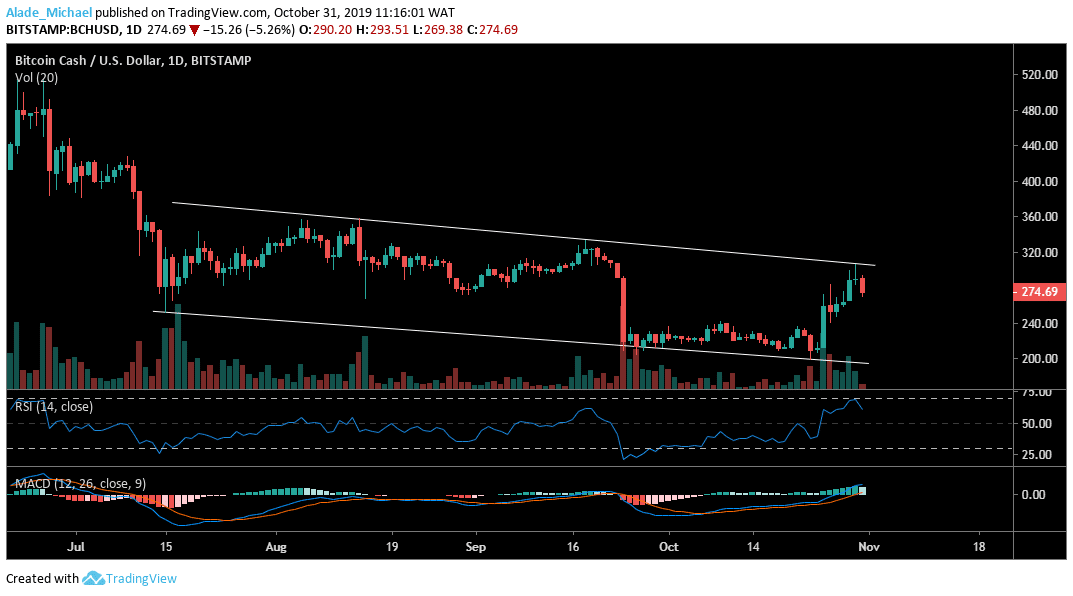

Bitcoin Cash (BCH) Price Analysis: Daily Chart – Bullish

Key resistance levels: $306, $335, $358, $370

Key support levels: $270, $250, $242, $206

Last week, we mentioned the triangle breakout but now Bitcoin Cash is shaping inside a descending channel pattern since mid-July. The October 25 rebound at $206 has made BCH record a weekly high of $306 while trading in a channel boundary. Yesterday, the price was rejected at $306 and now looking for support at $270 which was recently rejected.

A daily close below the $270 would bring us to $250, $242 and 206 support in a couple of days. Today, the RSI 70 was rejected to signal a potential reversal, although the MACD has seen a bullish climb which shows that the buyers lurk around the corner. If $270 area can act as support, we may see a bullish continuation to $335, $358 and $370. However, we need to clear the $306 resistance before considering a further rise.

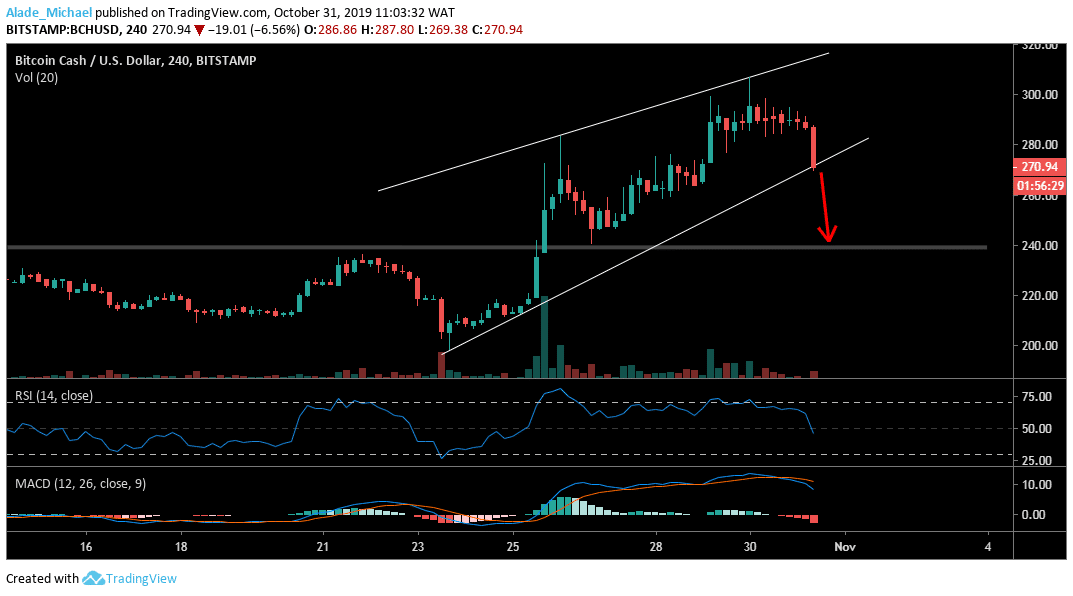

Bitcoin Cash (BCH) Price Analysis: 4H Chart – Bullish

The 4-hour chart is looking bullish but underway for a bearish move. At the time of writing, Bitcoin Cash is testing the ascending wedge’s support at $270.94 following the last 24-hours low volatility which was characterized by doji candles. Meanwhile, the current bearish candle formation has just signalled a bearish footing. Support is likely at $250-$240 areas once we have a clean wedge break-down.

Surging below grey horizontal support might further turn BCH weak at $220 and $210. While the RSI crosses down the mid-band, the MACD is positive but now oscillating towards the zero levels. Alternatively, we can expect a bounce if the wedge’s lower boundary can support the market. The resistance to watch out for is $290-$306 zones, although further buying target lies at $320. For now, Bitcoin Cash remains bullish but a breakout is imminent!

BCH SELL SIGNAL

Sell Entry: $269

TP: $243 / $212

SL: $310

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.