Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you are unlikely to be protected if something goes wrong. Take 2 minutes to learn more

Price activities in the Bitcoin Cash market have barely stayed above the $220 price mark, since about five trading sessions ago. As of then, price action crashed through the support level at the $230 price mark. However, buyers have received a significant push, which has brought the token back above the once-lost support level of $230.

BCH Statistics:

Bitcoin Cash Value Now: $233

BCH Market Cap: $4,537,405,284

BCH Circulating Supply: 19,469,919 BCH

Bitcoin Cash Total Supply: 19,469,881 BCH

BCH CoinMarketCap Ranking: 17

Major Price Levels:

Top: $233, $235, and $237

Base: $230, $228, and $225

Bitcoin Cash Bulls Get the Needed Push

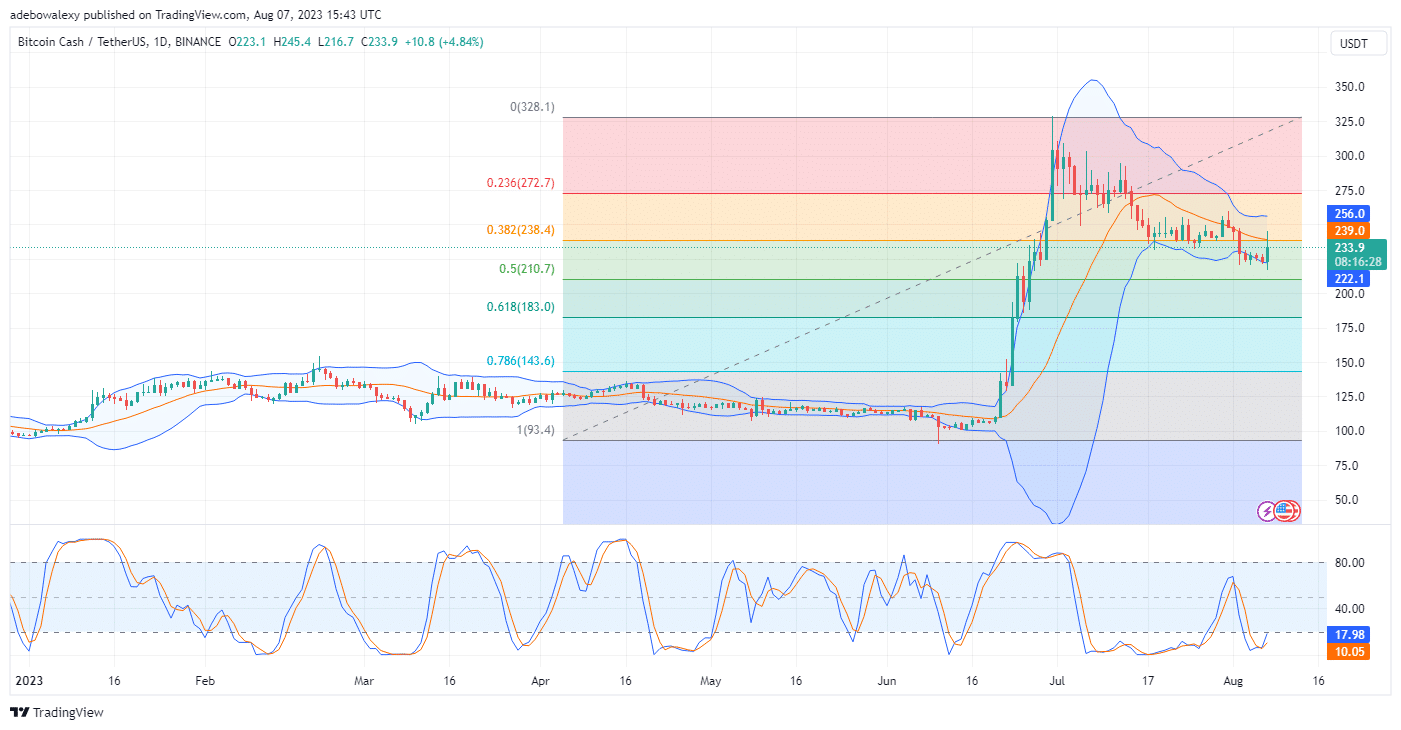

In the Bitcoin Cash daily market, price action has received a significant push off the lowest band of the Bollinger Bands indicator. This occurred after price action in this market spent some downtime gliding just above the $220 price mark. However, the ongoing session seems to have seen a change in that narrative.

At this point, the shadow of the last price candle can be seen piercing through the middle limit of the Bollinger Bands and the 38.20 Fibonacci Retracement level. Additionally, the Relative Strength Index (RSI) indicator lines can be seen rising upwards from the oversold level after they have performed an upside crossover. This is suggesting that the market now has an upside trajectory. But the question is: how far can buyers ride the momentum?

BCH Buyers Are Facing Rejection Near the $240 Rice Level

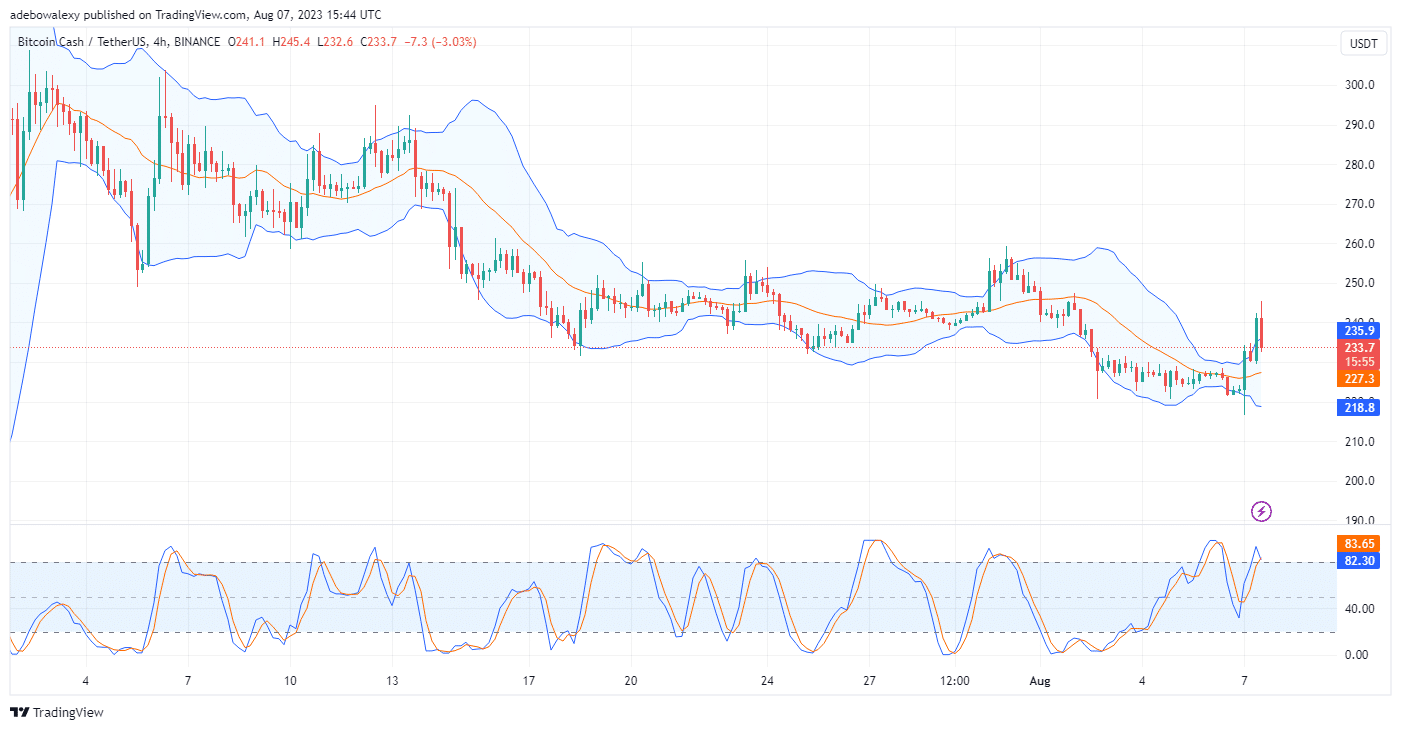

In the BCH 4-hour market, one could see that the price candle for the previous season pushed the uppermost band of the Bollinger Bands. Subsequently, a downward correction resulted in the following session (the ongoing session). Consequently, the Stochastic RSI indicator lines have converged for a bearish crossover, with the tips of these lines touching each other.

Nevertheless, we should note that price action still remains a considerable distance above the middle limit of the Bollinger Bands. This seems to still hold the opinion that upside forces may continue pushing prices higher. So traders can still hold on to their expectations of prices rising towards the $250 mark.

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.