Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you are unlikely to be protected if something goes wrong. Take 2 minutes to learn more

BTCUSD Bulls are Losing Ground as Sellers Gain Momentum

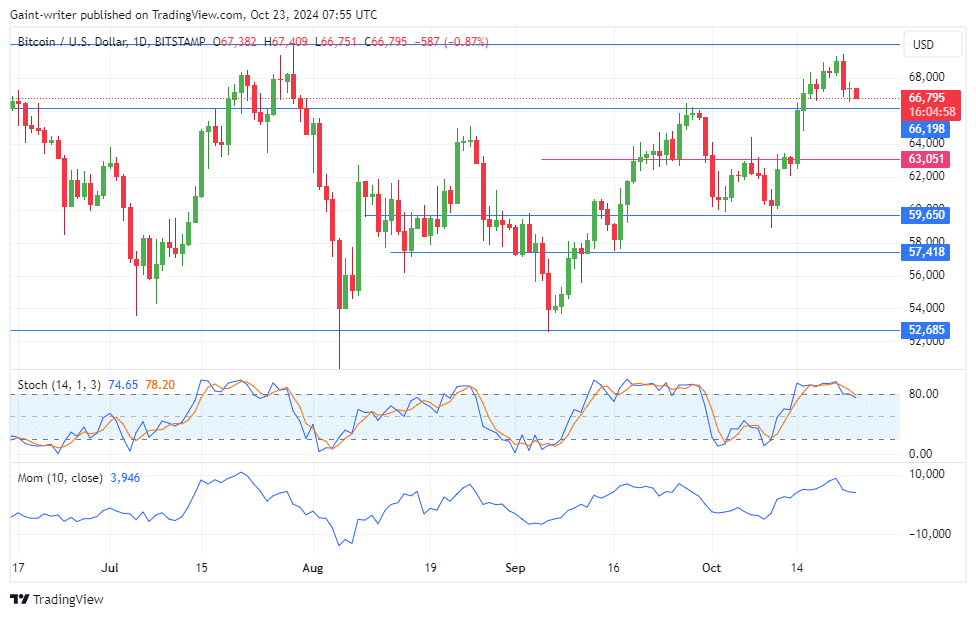

Bitcoin bullish strength is declining as the price moves closer to the $66,190 key level. The bullish momentum that dominated earlier in the month has started to fade, with buying pressure gradually diminishing. The bulls, who had initially pushed the price near the $70,000 mark, are now pulling back, unable to sustain the upward momentum needed to drive the price higher.

BTCUSD Market Levels

Resistance Levels: $70,000, $68,300

Support Levels: $66,190, $64,000

However, in recent days, the bullish momentum has weakened, and the market is now retracing toward the $66,190 support level. This crucial area will determine whether the market can withstand further selling pressure or if the bears will push the price lower.

The Stochastic Oscillator indicates a critical juncture, suggesting that the sellers may have the upper hand. This indicator signals that the market may be nearing overbought conditions, giving the bears an opportunity to gain more control. Additionally, the Momentum indicator is showing signs of weakening, reflecting the bulls’ struggle to maintain upward pressure as selling sentiment increases.

Market Expectation

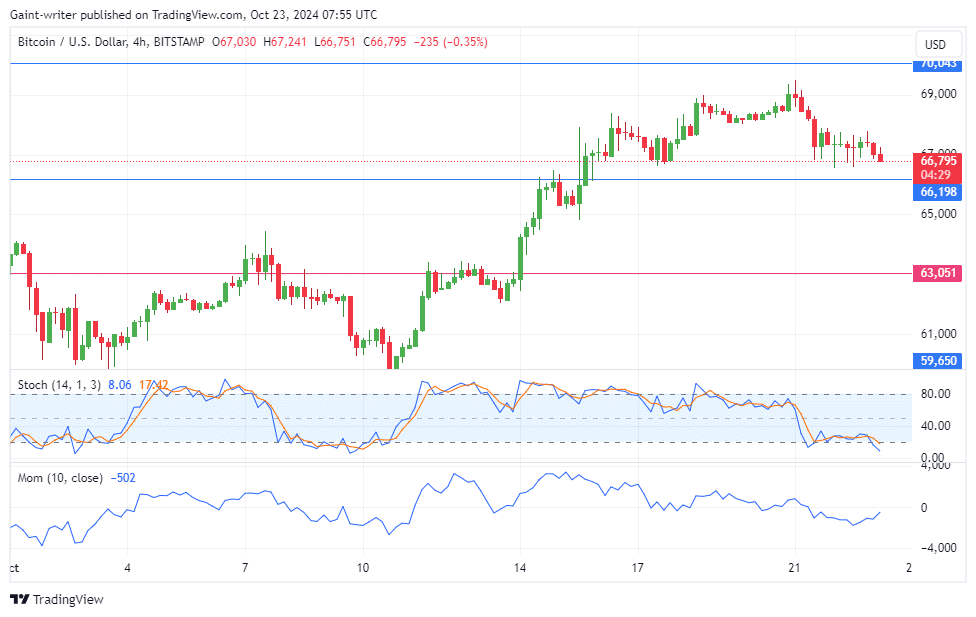

In the short term, the Bitcoin crypto is consolidating above the $66,190 key level, with neither buyers nor sellers fully in control. The Stochastic Oscillator on the shorter time frame suggests that sellers may soon reach the end of their dominance, creating a potential opportunity for buyers to re-enter the market.

Make money without lifting your fingers: Start using a world-class auto trading solution

How To Buy Lucky Block – Guide, Tips & Insights | Learn 2 Trade

Note: Learn2.trade is not a financial advisor. Do your research before investing your funds in any financial asset, product, or event. We are not responsible for your investment results.

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.