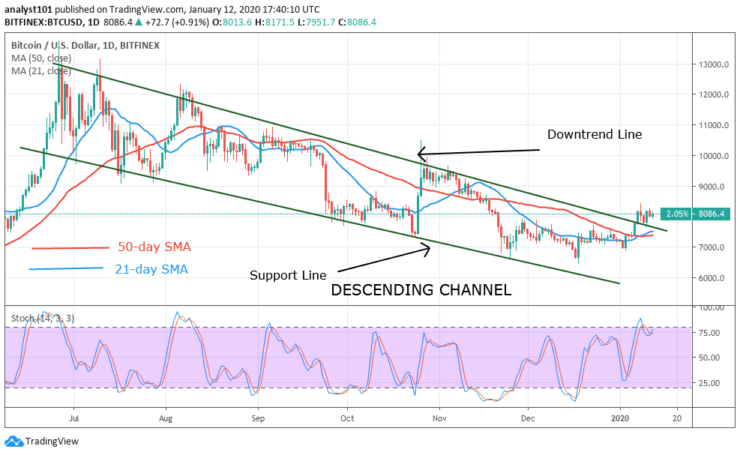

Key Support Zones: $7, 000, $6, 000, $5,000

BTC/USD Long-term Trend: Bullish

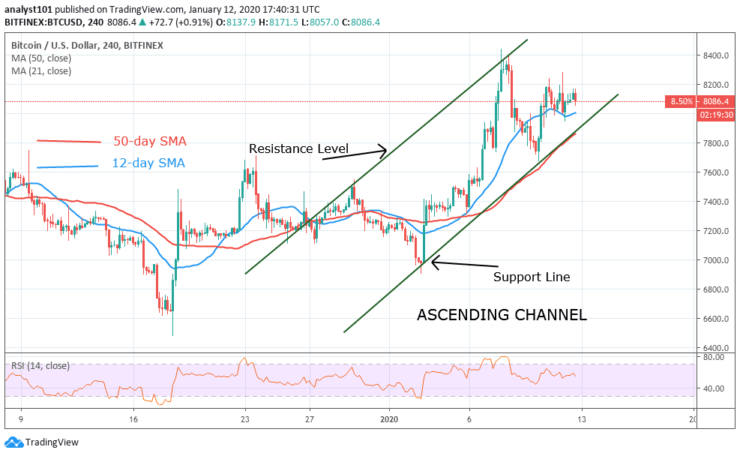

In the last 48 hours, the bulls have shown strength as they continue to sustain prices in the bullish trend zone. On January 10, Bitcoin made a retest at $8,200 and pulled back. The coin now fluctuates below the $8,200 resistance level but above the $8,000 support level. This fluctuation is a period of pause as the coin takes a breather.

The implication is that the price may breakout or breakdown. Surprisingly, Bitcoin will drop to the low of $7,000, if the bears break below the $8,000 price level. Conversely, the coin will rally above the $8,400 resistance, if the bulls break above $8,200 . Meanwhile, the fluctuation is ongoing as the coin makes an upward move.

Daily Chart Indicators Reading:

On December 7, the price broke the downtrend line and closed above it. The upward movement will be guaranteed if the bulls hold above the downtrend line. Meanwhile, the coin will be in a negative position, if the bears break below the downtrend line. The market is in a bullish momentum as it trades above 75% range.

BTC/USD Medium-term bias: Bullish

On the 4 hour chart, the market is fluctuating between $8,200 and $8,000. Each time the bulls test the resistance at $8,200, the price will drop to the $8,000 low. The bulls are desperate as the coin moves up for the third time.

4-hour Chart Indicators Reading

The price bars are above the 12-day EMA and the 26-day EMA indicating price upward move. The Relative Strength Index (RSI) period 14 level 57 indicates that the coin will rise as it is above the centerline 50. Nevertheless, if the price falls below the EMAs, the coin will drop.

General Outlook for Bitcoin (BTC)

Bitcoin’s upward move is likely to reach its target price of $9,200. The price is above the EMAs and the downtrend line is breached. This gives us the assumption that Bitcoin has the chance of an uptrend. On the upside, if the bulls break the $8,400 resistance, Bitcoin will rally above $9,200.

BTC Trade Signal

Instrument: BTC/USD

Order: Buy

Entry price: $8,000

Stop: $7,500

Target: $10,300

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.