Key Demand Zones: $7, 000, $6, 000, $5,000

BTC/USD Long-term Trend: Ranging

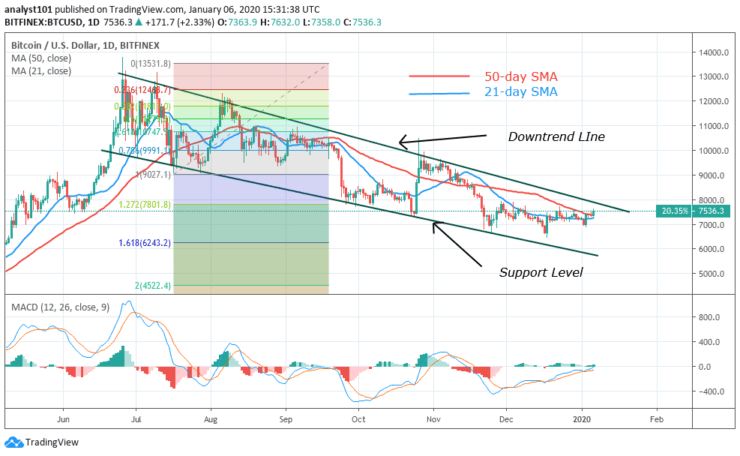

Bitcoin had its last bearish impulse at the low of $6,400 on November 24. The price corrected upward but the overwhelming selling pressure brought the price to its low on December 18. The support at $6,400 is holding as the market makes an upward move.

The coin is likely to face resistance at the $7,600 and $7,800. Nonetheless, if the price breaks above the resistance levels, Bitcoin will rally above the $9,200 supply zone. Conversely, if the bulls fail to break the resistance levels, Bitcoin will fall and resume a range-bound movement.

Daily Chart Indicators Reading:

The MACD line and the signal line are still below the zero line which indicates a sell signal. This is contrary to the price action where the prices are rising. Meanwhile, the blue and red bands of MACD are approaching the zero line to cross above it. Bitcoin will be a buy signal if MACD crosses above the zero line. The price bars are above the 12-day SMA and 26-day SMA which signifies that Bitcoin is rising.

BTC/USD Medium-term bias: Ranging

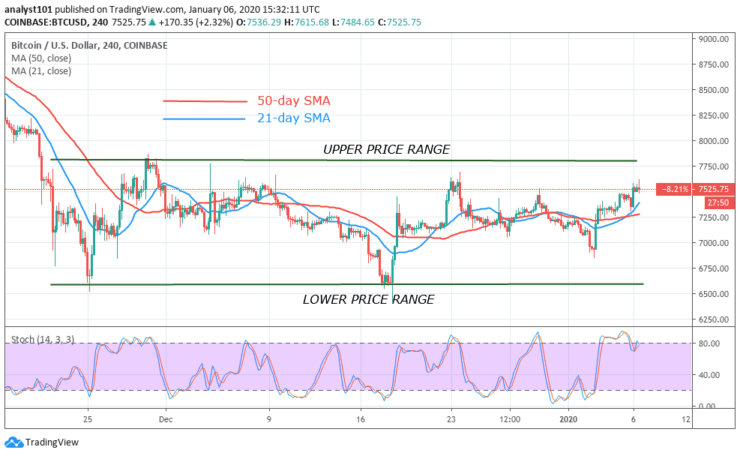

On the 4- hour chart, Bitcoin has been trading in a range-bound movement. Range bound traders can trade the key levels pending when the coin encounters a breakdown or breakout. When the market falls to the lower price range and holds, a long trade should be initiated. You exit such trade near the upper price range. When the market rises and retest the upper price range and the price is resisted, a short trade should be initiated. You exit such trade near the lower price range.

4-hour Chart Indicators Reading

The 12-day SMA and the 26-day SMA are trending horizontally indicating that the coin is ranging. Bitcoin traded and reached the overbought region of the daily stochastic. The coin has fallen below the 80% range of the daily stochastic. The bands have made a U-turn into the overbought area. The coin is still is in a bullish momentum.

General Outlook for Bitcoin (BTC)

Bitcoin is making an encouraging move to break above the overhead resistance. It is uncertain whether a breakout will occur. Yesterday the attempt on the resistance was unsuccessful. The coin fell to a low of $7,300. Today, the price is approaching the $7,600 resistance but the price action is forming small body indecision candlesticks below it.

BTC Trade Signal

Instrument: BTC/USD

Order: Buy Limit

Entry price: $7,300

Stop: $7,100

Target: $7,800

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.