Key Support Zones: $7, 000, $6, 000, $5,000

BTC/USD Long-term Trend: Bearish

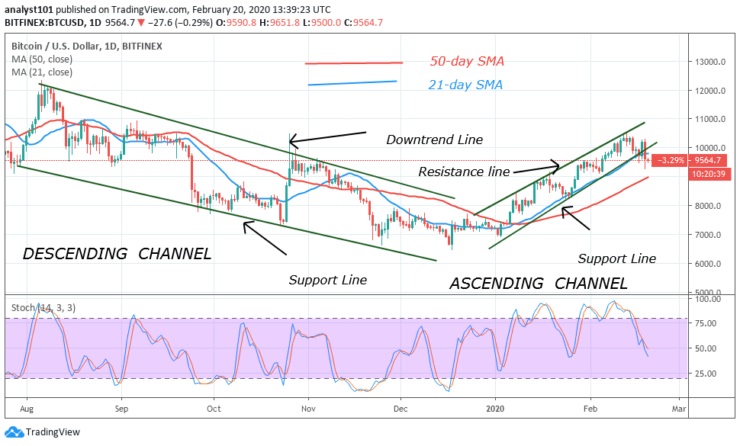

Undeniably, the bulls made two unsuccessful attempts at the $10,200 and were repelled. Bitcoin traded and fell to the low of $9,600 after the first failed attempt. The bulls pulled back and retested the $10,200 overhead resistance. Surprisingly, BTC nosedived to a low of $9,290. It pulled back but went into consolidation.

Nonetheless, after consolidation, the price will go either direction. It is possible to see a repeat of the price action of October 2019. What we expect after the consolidation is either a breakdown or a breakout. On the downside, if price falls and breaks below $9,400, BTC will drop to a low of $8,400. On the upside, if price breaks above $9,800, the coin will reach a high of $10,400.

Daily Chart Indicators Reading:

Bitcoin is trading below a 50% range of the daily stochastic. It means that the coin is in bearish momentum. There is a likelihood of BTC falling. The lower line of the ascending channel has been broken by price. Technically, the selling pressure is likely to continue.

BTC/USD Medium-term Trend: Bearish

On the 4- hour chart, the resistances at $10,200 and $10,400 are knotty price levels. The bulls have failed to break these price levels because they are historical price levels in September 2019. However, if these levels are broken it will be the first since August 2019.

4-hour Chart Indicators Reading

Bitcoin is currently consolidating above $9,500. Similarly, the Relative Strength Index has fallen to level 38 and it is moving horizontally on a straight line. The breaking of the bullish trend line is an indication that the downward move is likely to continue.

General Outlook for Bitcoin (BTC)

Bitcoin is in a period of consolidation after the two successive falls. After the second successive fall of Bitcoin, the bears are on advantage because of further price action. All the indicators have shown that BTC is in the downtrend zone.

BTC Trade Signal

Instrument: BTC/USD

Order: Sell

Entry price: $9,560

Stop: $9,700

Target: $8,400

Note: Learn2Trade.com is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.