Key Support Zones: $7, 000, $6, 000, $5,000

BTC/USD Long-term Trend: Bullish

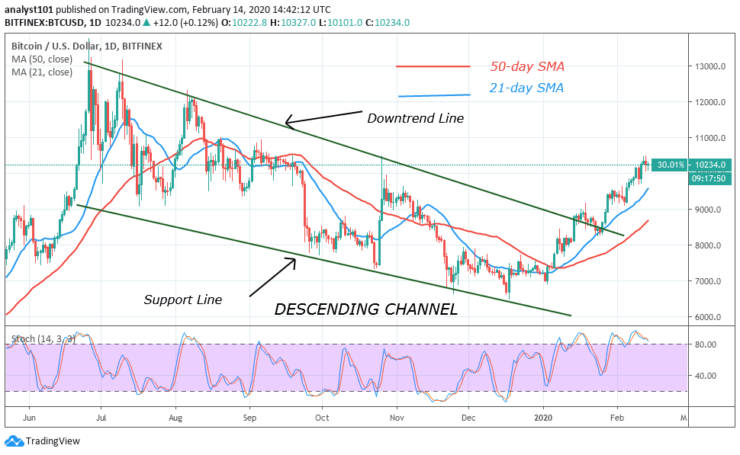

After February 11 breakouts, Bitcoin has been characterized by small body candlesticks like Doji and spinning tops. These candlesticks describe the indecision between the buyers and sellers concerning the direction of the market. The price is now fluctuating in a tight range between $10,200 and $10,400. This is the fourth day of indecision between the bulls and the bears.

Can we expect the bulls to break the next major resistance at $10,360? Then continue with the upward move. Or allow the bears to erase the bullish gains and take us back to the bear market? Definitely, in a matter of days, the $10,200 support or $10, 400 resistance will be broken to know the direction of Bitcoin. Meanwhile, Bitcoin is in consolidation above $10,200 support.

Daily Chart Indicators Reading:

Bitcoin has consistently remained to trade in the overbought region of the daily stochastic since on January 29. In the overbought region, the price is sloping between 95% and 80% range. This makes the bullish momentum to linger in the overbought region. Meanwhile, as soon as the bullish momentum is exhausted, sellers will take control in the overbought region.

BTC/USD Medium-term Trend: Bullish

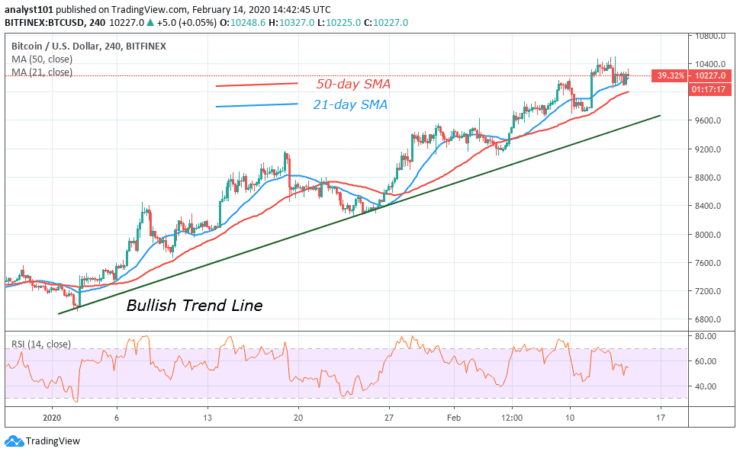

On the 4 hour chart, the market has remained the same in the last four days. The bulls and bears have failed to breach the respective levels as the market continues its range-bound movement. The bears have carefully defended the $10,400 price level. Similarly, the bulls are also putting the bears far away from the current support.

4-hour Chart Indicators Reading

The Relative Strength Index period 14 level 56 indicates that Bitcoin is in an uptrend zone. The coin is above the centerline 50 which indicates that the coin will rise. The 21-day and 50-day SMAs are sloping horizontally indicating the uptrend.

General Outlook for Bitcoin (BTC)

Bitcoin is now in consolidation above $10,200 as the bulls fail to break the next major resistance. The RSI period 14 and the daily stochastic have all indicated that the price is in the uptrend zone. The market intends to rise. As the market continues its consolidation, we should expect a breakout and breakdown.

BTC Trade Signal

Instrument: BTC/USD

Order: Buy

Entry price: $10,234

Stop: $10,000

Target: $11,000

Note: Learn2Trade.com is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.