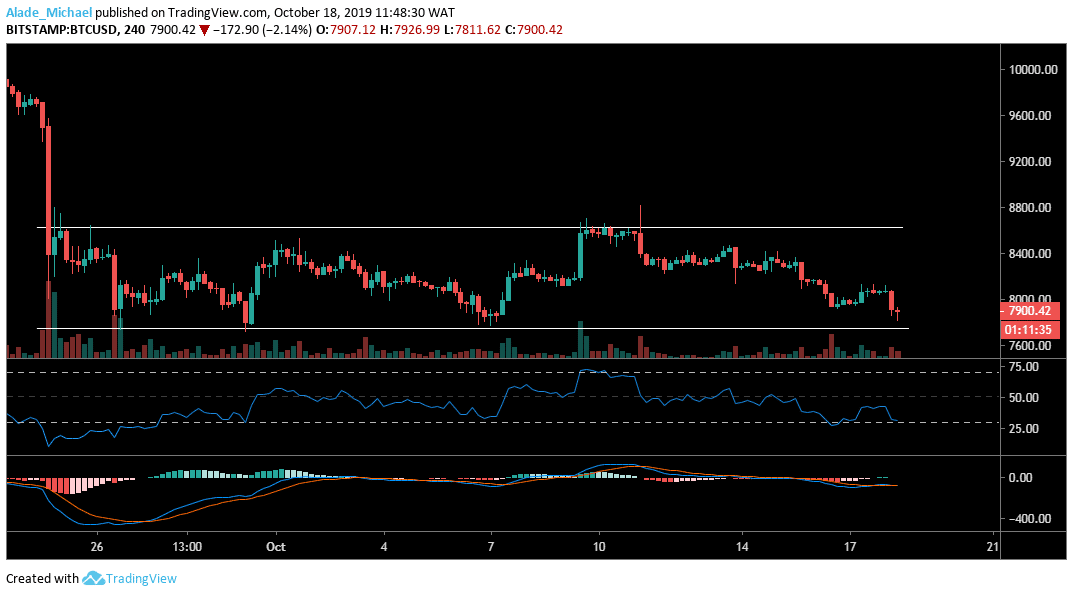

Bitcoin (BTC) Price Analysis: 4H Chart – Neutral

Key resistance levels: $8000, $8270, $8453, $8650

Key support levels: $7733, $7500, $7300, $7000

Bitcoin is moving sideways on the hourly chart. The $8800 rejection has led the market into 7 days bearish action which has currently brought Bitcoin to $7900. Meanwhile, the $7700 price zones now correspond with the RSI 50 level, where Bitcoin currently held support.

We can expect a rise back above $8000 toward the channel’s resistance at $8270, $8453 and $8650 before a potential break-up. On the other hand, support is likely at $7500, $7300 and $7000 if the $7733 could not contain selling pressure. However, the MACD indicator shows that the bears are in play for now.

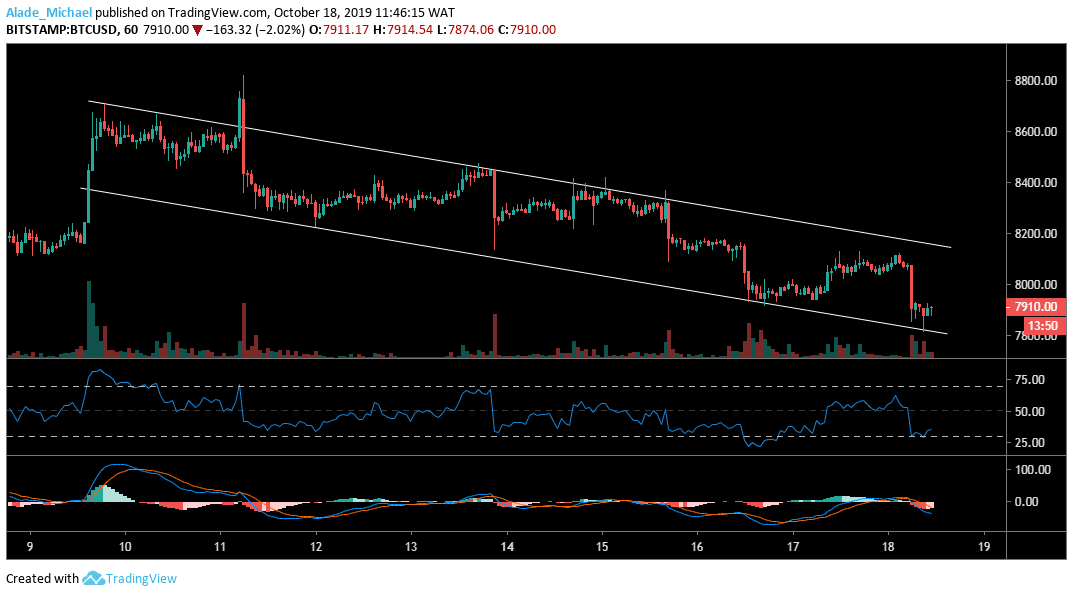

Bitcoin (BTC) Price Analysis: Hourly Chart – Bearish

The October 11 false breakout has led Bitcoin’s price in a downward range and at the same time shaping in a channel boundary. However, it’s important to note that the bears are becoming strong on a short-term move. Just a few hours ago, Bitcoin tested the channel’s support at $7800 and now waiting for a possible correction to $8100 resistance.

As we can see, the RSI indicator is bolstered by the 30 level, although still weak at the moment. Similarly, the crypto trading signals a bearish cross on the MACD indicator which may cause Bitcoin to keep falling if the signals play out.

On the downside, $7600, $7400, $7200 and $7000 may be explored. On the upside, $8200, $8400 and $8600 may play out if a bullish surge occurs. For now, BTC is currently weak on the hourly time frame.

BITCOIN SELL SIGNAL

Buy Entry: $7870

TP: $8091 / $8270

SL: $7700

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.