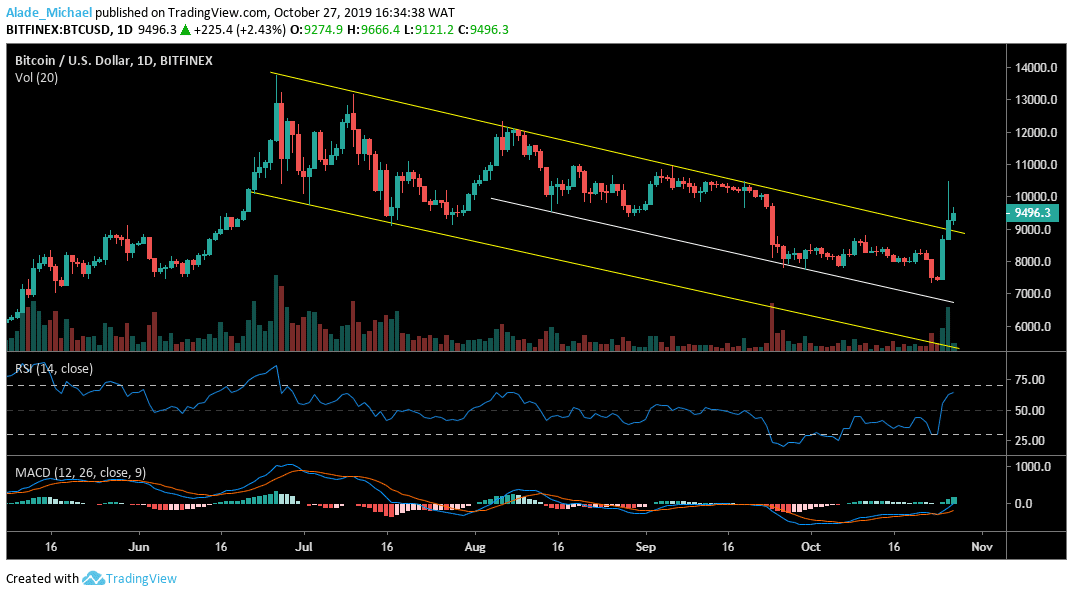

Bitcoin (BTC) Price Analysis: Daily Chart – Bullish

Key resistance levels: $9800, $10000, $10500

Key support levels: $9033, $8800, $8400

Bitcoin has slightly moved out of the four months descending channel after finding support around $7300 last week. After seeing a price increase of about $3000 in two days, the BTC price has now slipped a bit near the $9000 support but now changing hands at around $9500.

A look at the daily chart suggests that the bulls are back in the market. As we can see, the crypto trading signals that RSI has turned back positive. We may see a climb back to $9800, $10000 and $10500 resistance. Conversely, the MACD is slowly turning positive but yet to produce a crossover.

Bitcoin is currently relying on the $9000 support. A break beneath the mentioned might cause the price to trade back inside the channel formation at $8800 and $8400. For now, the BTC/USD pair is following a bullish sentiment.

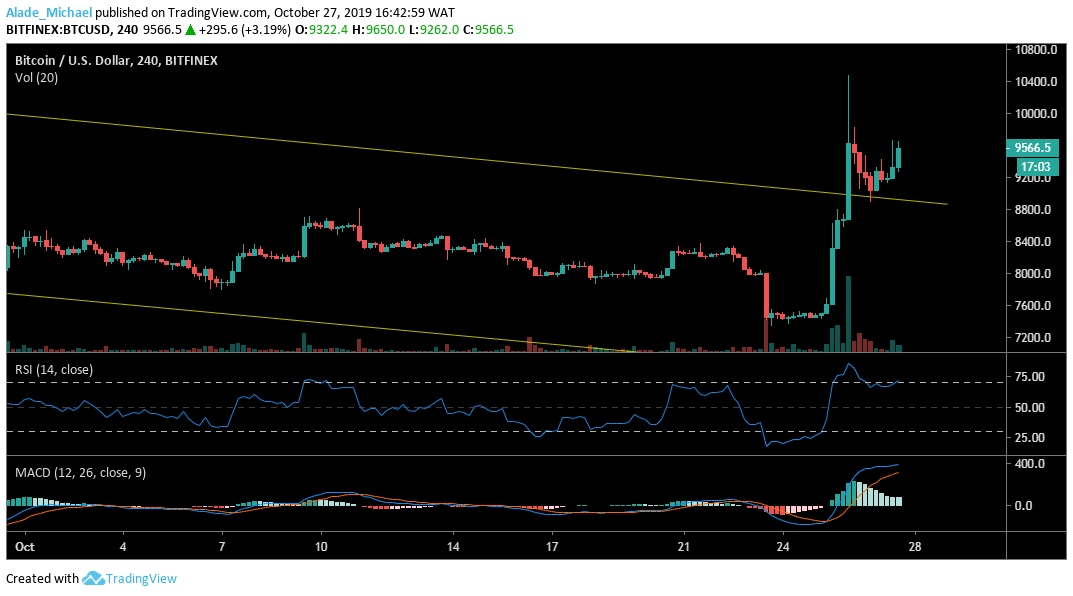

Bitcoin (BTC) Price Analysis: 4H Chart – Bullish

Looking at the bigger picture, Bitcoin is currently sitting on the medium-term channel’s support at $8800; which is a bearish breakout on the 4-hour chart. However, $8500 and $8200 support may further bolster as support if a bearish leg occurs.

Following the recent price cut, the RSI has sharply dropped from the overbought zone but now attempting to cross back to the above 70 levels. The MACD shows that the bulls are in play. We can expect the next resistance at $9800 and $10000. A further rise could allow BTC to test the $10200 and $10400.

BITCOIN BUY SIGNAL

Buy Entry: $9451

TP: $9953

SL: $8900

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.