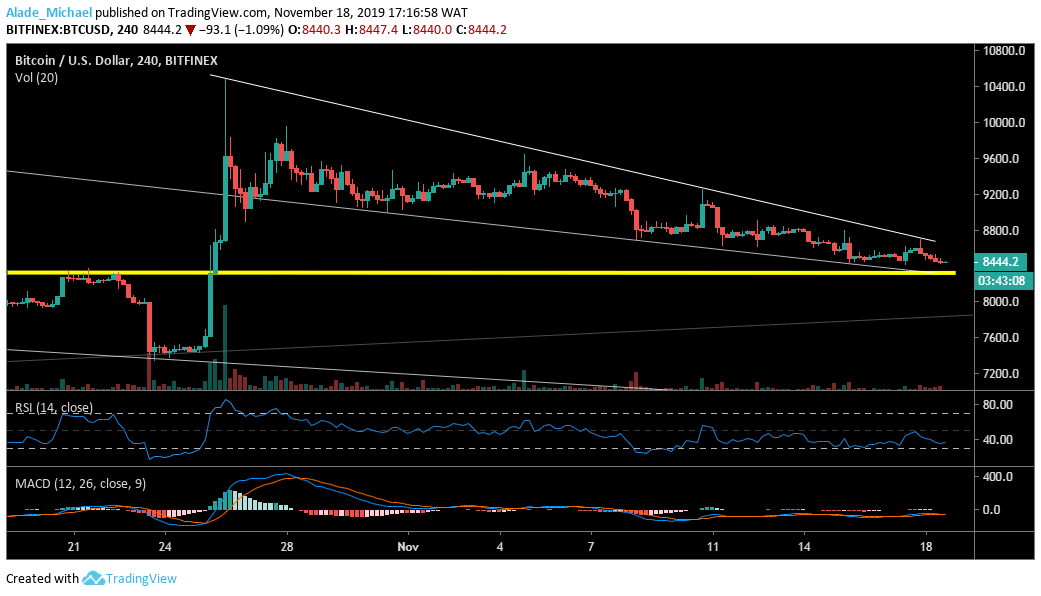

Bitcoin (BTC) Price Analysis: 4H Chart – Bearish

Key resistance levels: $8500, $8600, $8800

Key support levels: $8300, $8200, $8100

Reclaiming $9000 resistance might be a little challenging for Bitcoin on the 4-hour time frame if the sellers continue to release selling pressure in the market. The selling has been causing a lot of bearish sentiment, especially the last 24-hours drop all the way from $8699 yesterday. Bitcoin is slightly trading above the $8400 support, although new weekly support is likely at $8100 if the yellow horizontal support breaks.

As per the wedge pattern forming on the chart, Bitcoin’s volatility is seriously contracting to the angle of the wedge. As such, a big price explosion is around the corner. However, the RSI has found support for BTC at the oversold level which may cause the market to bounce to $8600 resistance if the RSI level holds. A break to $8800 resistance might return positive move in the market. All in all, Bitcoin remains bearish on the MACD.

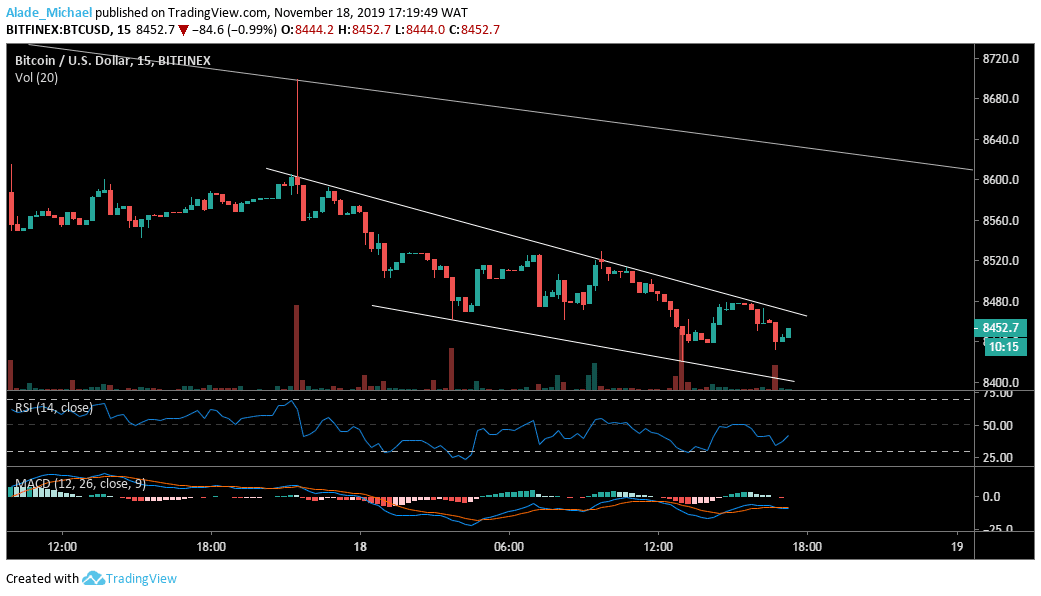

Bitcoin (BTC) Price Analysis: 15M Chart – Bearish

The rejection at $8699 resistance has caused an outright $250 cut from Bitcoin’s price since yesterday. Currently, the market is moving in a descending wedge on the 15-minutes time frame. Bitcoin is likely to move out of the wedge soon. On the upside, the key resistance to watch out for is $8500 and $8600.

As we can see, the technical RSI is poised for a bullish move. Though, the MACD shows that the bears are still gaining control of the market. On the other hand, we may see more selling pressure towards the $8400 support. If BTC drops beneath the mentioned support, we can expect $8300, $8200 and $8100 to suppress selling pressure.

BITCOIN BUY SIGNAL

Buy Entry: $8447

TP: $8587

SL: 8375

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.