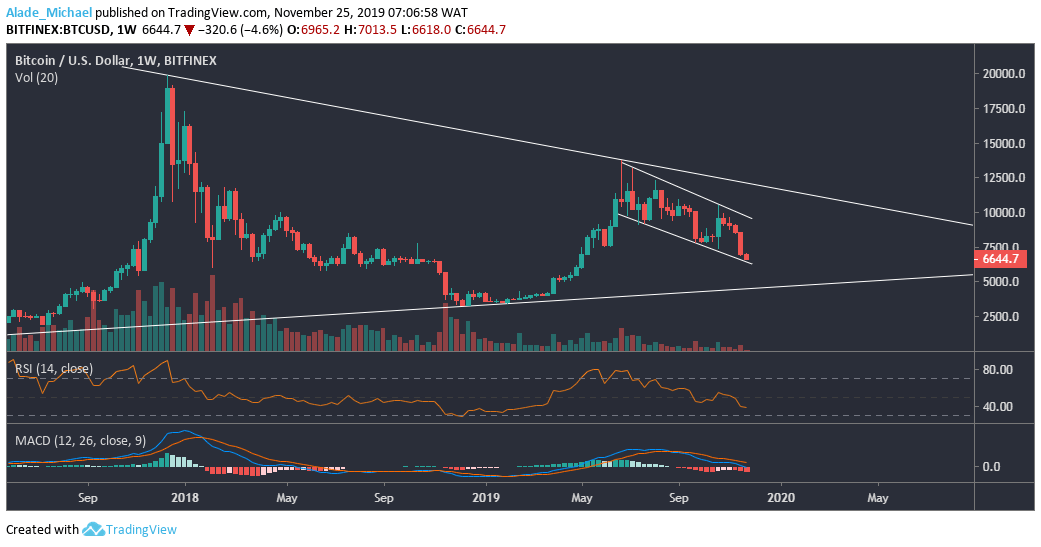

Bitcoin (BTC) Price Analysis: Weekly Chart – Bearish

Key resistance levels: $6800, $7000, $7500

Key support levels: $6400, $6000, $5000

The weekly chart shows a strong bearish setup that could slip Bitcoin’s price to $5000 in the coming weeks, if the market continues to respect the symmetrical triangle pattern that has been forming since March 2017. However, there’s a need for BTC to break minor support of $6400 and $6000, the 2018 low.

If Bitcoin can find support on these price zones, we may see a correction to $7500. But for now, $7000 is close for a retracement move. Meanwhile, BTC is looking for support on the RSI 30 level. Despite the bearish scenario, Bitcoin has remained positive on the weekly MACD indicator to show that there’s still hope for a bullish move.

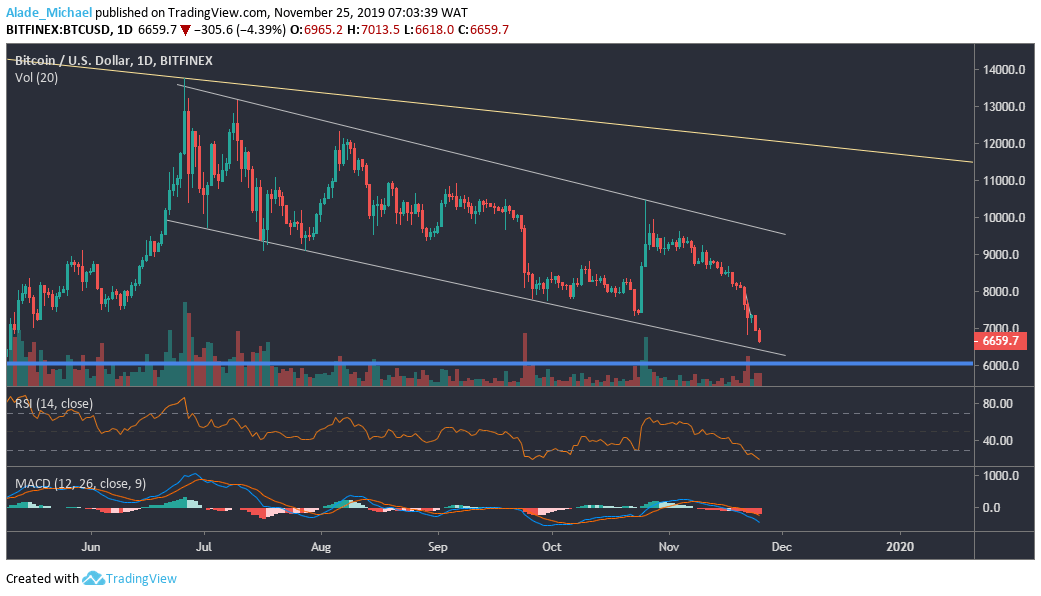

Bitcoin (BTC) Price Analysis: Daily Chart – Bearish

On the daily chart, Bitcoin is almost testing the channel’s lower boundary following the latest selling pressure in the market. The four weeks of bearishness has made BTC nosedive into the extremely oversold region on the RSI indicator. In the same vein, the MACD has recently produced a bearish cross to show that the bears have taken over the market.

Currently, Bitcoin is trading around $6668 after witnessing a $500 price cut under 24-hours. A further decline could extend sell-off to $6400 and $6000, where the purple support line lies. However, a bounce-back is likely if these support areas can hold. For now, the level of resistance to watch is $6800 and $7000.

BITCOIN SELL SIGNAL

Sell Entry: $6666

TP: $6400

SL: 6812

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.