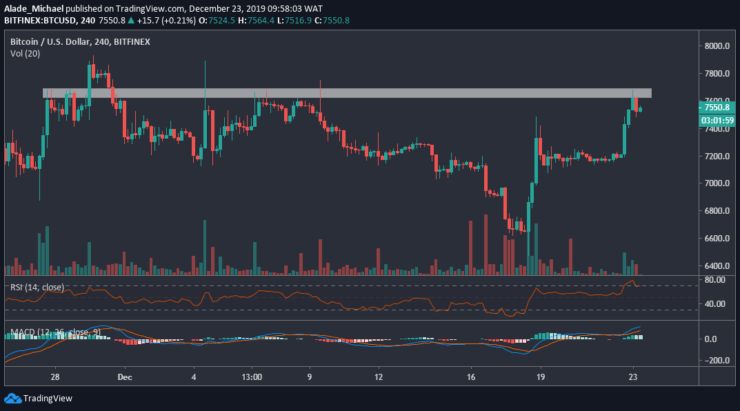

After breaking last week’s high of $7440, Bitcoin is now preparing for another bullish rally which is likely to reach $8200 in a couple of days. But currently, it appeared that the $7700 resistance is suppressing bullish pressure. Nevertheless, we can expect a more positive move as soon as BTC climbs above this mentioned resistance. For now, BTC is following a bullish sentiment.

Bitcoin (BTC) Price Analysis: 4H Chart – Bullish

Key resistance levels: $7700, $7900, $8200

Key support levels: $7350, $7160, $7000

Bitcoin is looking bullish on the 4-hour chart following last 24-hours buying that allowed the price to hit $7700. Currently, the price has dropped slightly to $7500. If the buyers regroup and surpass the immediate resistance of $7700, we can expect further growth to $7900 and $8200 within a blink.

Meanwhile, a downward correction could allow a retest at $7350, although $7160 and $7000 support may further be explored if a heavy drop occurs. Taking a look at the RSI indicator, we can see that Bitcoin has significantly formed a bullish pattern. The MACD is conversely positive, indicating that buyers are stepping back into the market.

Bitcoin (BTC) Price Analysis: Hourly Chart – Bullish

Following recent price increase, Bitcoin has found resistance at the upper boundary of the wedge, forming since December 17. Now, the price is looking for support on the wedge’s lower boundary at $7350. If the wedge breaks down, a huge selling is likely to play to $7160, $7000 and potentially $6800 support.

But looking at the bullish setup, an intense buying is expected to play out. The next level of resistance to watch out is $7700, $7888 and $8000. Moreover, we can see that RSI is currently bullish along with the MACD, which is now trending well in the positive zone. We can expect a small downward correction before buying pressure resumes.

BITCOIN BUY SIGNAL

Buy Entry: $7350

TP: $7700 / $7900

SL: $7150

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.