Bitcoin miners are facing decreased profitability as the hash rate declines.

Roughly a month following the fourth Bitcoin halving, initial indications of miners experiencing reduced revenues are beginning to surface, with a prominent signal being the decrease in the network hash rate.

This recent decline in hash rate suggests potential miner capitulation, as less efficient miners may be exiting the market due to declining profitability.

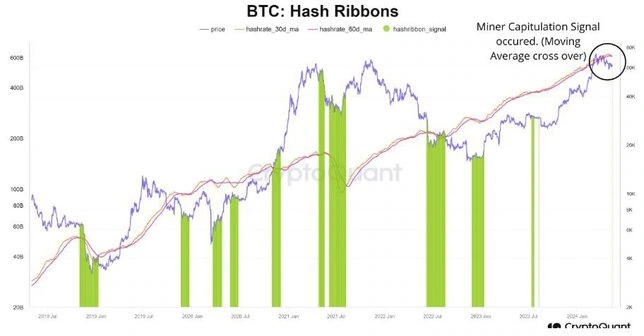

Indications of Capitulation Emerge in Hash Ribbons

Previously, the 30-day moving average of the hash rate peaked at 630 exahashes per second (EH/s), but it has since dropped to 606 EH/s. Although this decline is relatively minor and temporary, it’s significant because the hash rate typically trends upward, indicating a shift in pattern.

CryptoQuant’s research has identified instances of rapid hash rate declines, often indicating “miner capitulation.”

“Miner capitulation” refers to less efficient miners exiting the mining process by shutting down their rigs, leading to decreased computational power for mining.

Some may also relocate or sell recently mined bitcoins to cover operational costs.However, it’s essential to recognize that miner capitulation doesn’t occur immediately after the initial signal from Hash Ribbons. Instead, it unfolds gradually over subsequent days and weeks as less efficient miners exit the market.

Plunge in Miner Profitability

Following the halving event on April 20th, the block reward was slashed in half to 3.125 BTC, resulting in a decrease in daily mining output from 900 BTC to about 450 BTC.

Consequently, major Bitcoin miners such as Bitfarms, Cipher, CleanSpark, Core Scientific, Riot, and Terawulf experienced production declines ranging from 6% to 12% in April, as reported by The Miner Mag.

These decreases in output have coincided with a drop in profitability, or ‘hash price,’ which has decreased to $0.049 per terahash per second per day, according to HashRateIndex. This represents a decline of over 73% from the $0.182 TH/s/day level observed around the halving.

To have the best trading experience with us,open an account at Longhorn.

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.