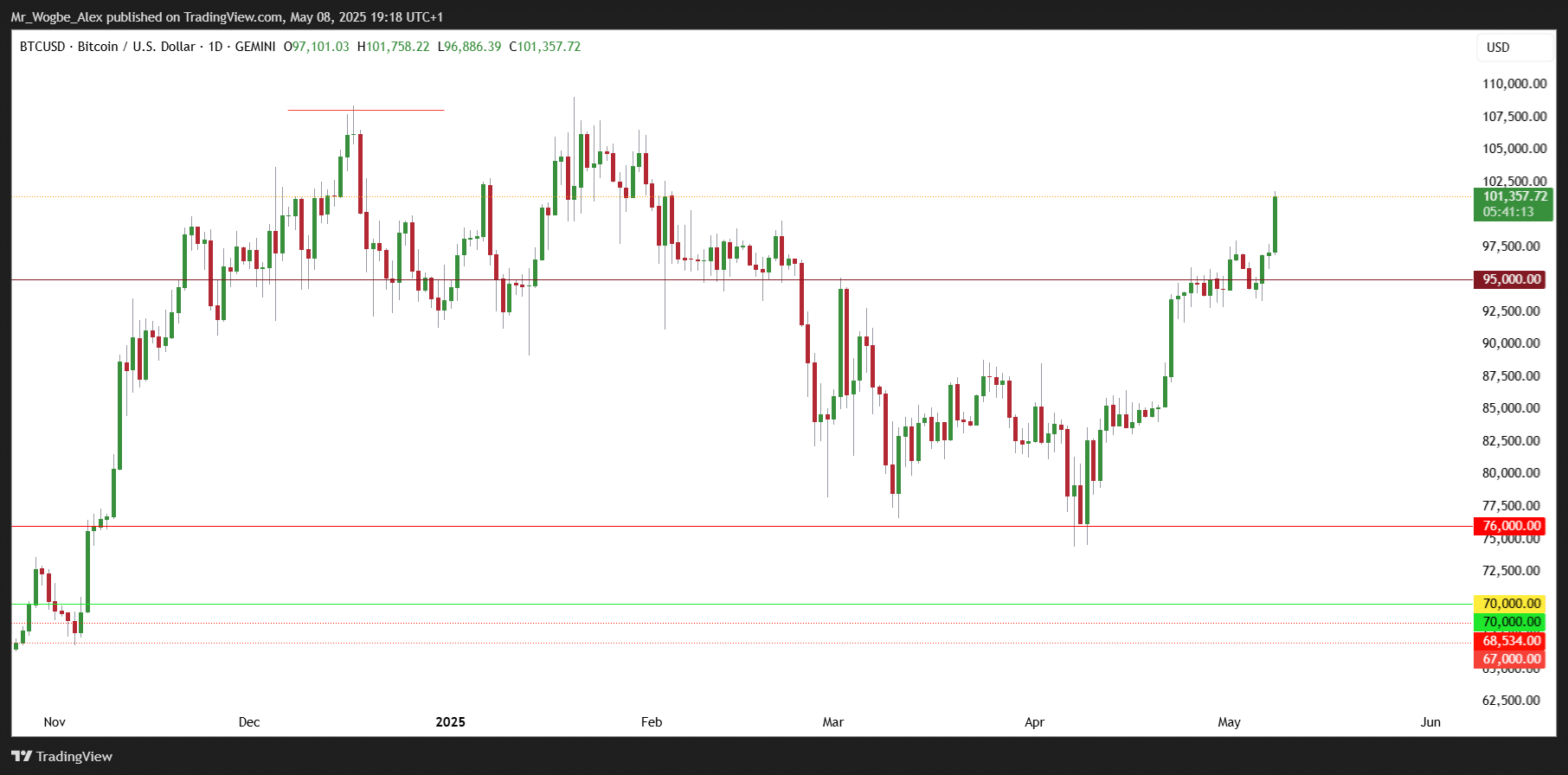

Bitcoin hit $100,000 today for the first time since February, driven by news of a major US-UK trade agreement. The world’s largest cryptocurrency jumped over 4% in a single day, continuing its strong recovery after falling to $74,415 in early April.

President Trump announced the trade deal on his Truth Social account earlier today, calling it “a full and comprehensive one that will cement the relationship between the United States and the United Kingdom for many years to come.”

The agreement with the United Kingdom is a full and comprehensive one that will cement the relationship between the United States and the United Kingdom for many years to come. Because of our long time history and allegiance together, it is a great honor to have the United…

— Donald J. Trump Posts From His Truth Social (@TrumpDailyPosts) May 8, 2025

The announcement triggered what traders call “risk-on sentiment” across markets, with Bitcoin being a major beneficiary.

Why Bitcoin Prices Are Climbing

Several factors are pushing Bitcoin higher, including:

- The US-UK trade agreement will reduce duties on steel and autos, easing supply-chain inflation fears that have worried investors since Trump’s administration began implementing tariffs last month.

- The stable Federal Reserve interest rates have created a more favorable environment for risk assets like Bitcoin.

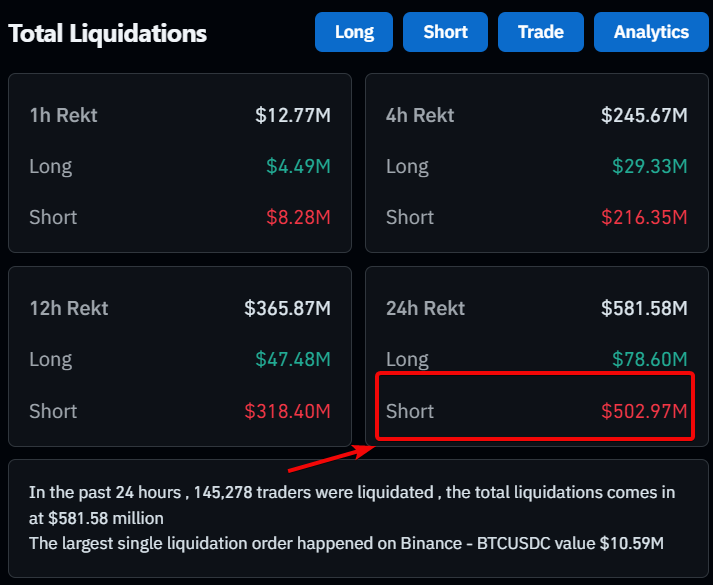

- A massive $503 million in short positions was liquidated across crypto trading platforms in the past 24 hours, according to CoinGlass data. This “short squeeze” helped push prices higher as traders who bet against BTC were forced to buy.

- Institutional interest continues to grow, with over $3.5 billion flowing into spot Bitcoin exchange-traded products in just the past three weeks.

Standard Chartered analyst Geoffrey Kendrick believes this rally could continue, telling The Block, “I think a fresh all-time high for Bitcoin is coming soon. My specific target of USD 120k for Q2 looks very achievable.”

Bitcoin’s Changing Market Role

Bitcoin’s relationship with other markets has shifted recently. Until last month, Bitcoin mostly moved alongside tech stocks. However, during April’s trade tensions, Bitcoin started acting as a hedge while stock markets dropped.

“Bitcoin then became a way to position for strategic asset reallocation out of U.S. assets. It is now all about flows,” Kendrick explained.

Strategy (formerly MicroStrategy) continues to be a major force in the market, currently holding 555,450 Bitcoins—about 2.6% of all Bitcoin that will ever exist.

The company has announced plans to raise an additional $84 billion to purchase more BTC, which would add approximately 840,000 coins to their holdings at current prices.

Traders are now watching to see if BTC can hold above $100,000, with many eyeing $105,000 as the next key resistance level.

Interested In Trading The Market With A Trustworthy Partner? Try Eightcap Today.

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.