Mazars has suspended all operations with crypto clients, including Binance, the world’s largest crypto exchange. Recently, the cryptocurrency industry has been under intense scrutiny as a result of the crises with the previously notable crypto exchanges FTX and FTX.US. According to a Bloomberg article, Mazar’s website currently has broken links that prevent access to earlier audit findings.

The giant crypto exchange contracted Mazars, an accounting company, to compile a “proof of reserves” report some weeks ago. Mazars had said they would temporarily halt all engagement with international crypto clients, including clients like Crypto.com, KuCoin, and Binance, according to a statement released by Binance today.

The crypto audit website appears to have been taken down, and Mazars has not made any additional announcements.

Following the fallout from cryptocurrency exchange FTX, the majority of top crypto exchanges, including Crypto.com, KuCoin, and Binance, partnered with Mazars to offer audit reports on their reserves in November.

Binance Suffers Massive Outflows

Binance had a withdrawal of over $1 billion earlier this week as worry surrounding centralized exchanges (CEX) reaches an all-time high. Binance claimed on Friday that “over the past week, Binance passed a stress test that should give the community extraordinary comfort that their funds are secure,” adding that it had been able to process recent withdrawals “without breaking stride.”

However, due to recent US Justice Department investigations against the crypto exchange about allegations of money laundering and tax avoidance, there was a subsequent outflow of funds.

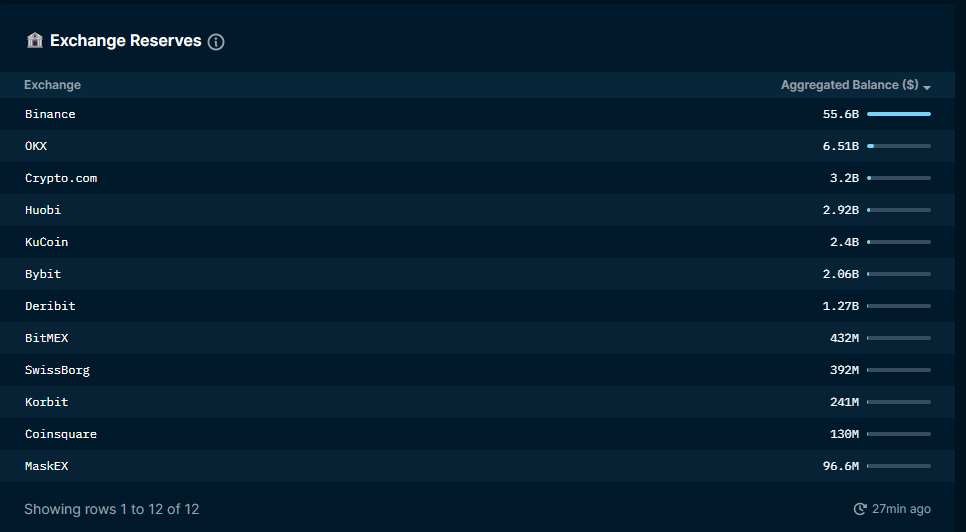

Binance previously acknowledged that it had more than $60 billion in assets, indicating that there should be enough money to cover all withdrawal requests. However, it has not yet disclosed its liabilities. Nansen Data, which confirms this amount, reveals that the crypto exchange has more than $55.6 billion in asset reserves.

In a statement released by Binance on Friday, the exchange acknowledged that it had made contact with several big auditing companies, including some of the Big Four, but that they were not willing to perform a proof of reserve for a private company at the time.

You can purchase Lucky Block – Guide, Tips & Insights | Learn 2 Trade here. Buy LBLOCK

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.