Worth mentioning is the organic authenticity of this rally compared to previous ones in past years, which indicates that it is curating a strong base for a fresh massive uptrend.

One way to spot the BTC organic growth is to look at exchange outflows, which appears to be gaining massively in recent months. This is a clear indication that investors are taking the long-term approach with their Bitcoin investments and also that there has been significant accumulation recently.

The combination of several fundamental factors with strong bullish technical bias shows that the next parabolic bull rally could be more than anything we’ve seen in previous years.

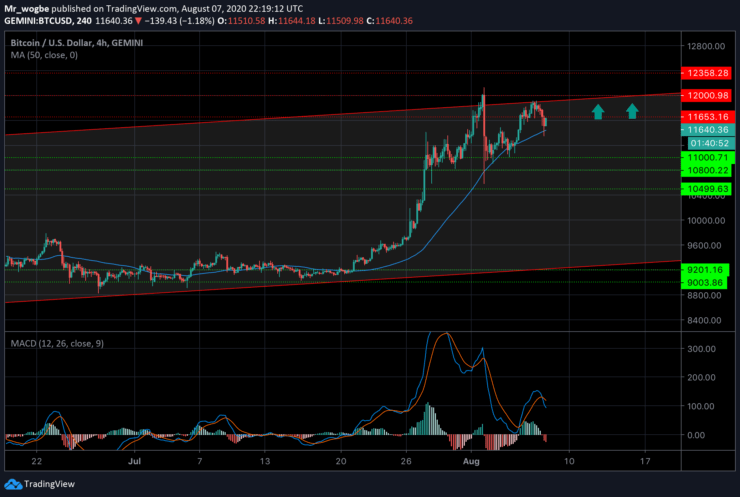

At press time, Bitcoin is trading at $11,640 after a better-than-expected US employment data provided some bullish strength for the US dollar, causing Bitcoin to retrace.

This retrace created an opportunity for some dip-buying, which could help the benchmark cryptocurrency break the $12,000 target.

Bitcoin Price Levels to Watch

The goodish US unemployment data caused Bitcoin to act according to how we specified it in yesterday’s analysis. BTC has now hit the $11,350 (50HMA) mark and is now heading back to the $12,000 level. That said, we’re likely to see a break above the $12,000 soon. After that, there’s a strong resistance to contend with at the $12,100 line followed by $12,250.

On the flip side, a break below $11,350 – $11,000 region could cause BTC to see the $10,800 support again

Total Market Capital: $350.2 billion

Bitcoin Market Capital: $214 billion

Bitcoin Dominance: 61.1%

Note: Learn2.trade is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.