The dollar is trying to stabilize after recovering from a strong rally in US Treasury yields, which is also confirmed by a sharp drop in gold prices. The development keeps gold in a corrective pattern from 2075.18. That is, a break below support at 1848.39 is now back in sight.

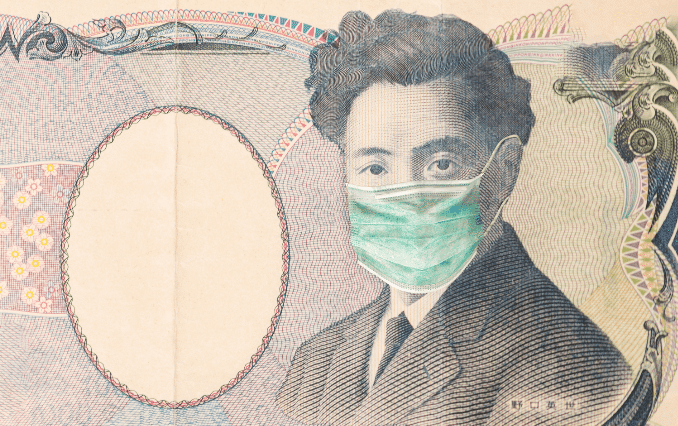

At the very least, development argues that the focus on selling is no longer that of the dollar alone. The selling of the yen finally soared even against the weak dollar. The Australian dollar is outperforming other commodity currencies. The world, at least in financial markets, is today in euphoria over news that tens of millions of doses of coronavirus vaccine are ready this year to lift it out of the coronavirus pandemic, which has claimed more than 1.2 million lives.

The sentiment was boosted after Pfizer and BioNTech announced today that their COVID-19 vaccine is now more than 90% effective.

Companies have already begun production of the vaccine, not yet knowing if it will work to save time and help fight the pandemic that has hit the world since February. They expect to produce up to 50 million doses to protect 25 million people this year. 1.3 billion doses of the vaccine are expected to be administered in 2021.

The Summary of Views at the October 28/29 Bank of Japan Monetary Policy Meeting noted that “the fight against COVID-19 can continue.” The central bank “should avoid premature termination of its current monetary policy measures.” The Bank of Japan must “exercise the utmost vigilance against the possibility of sudden changes in financial markets and adopt flexible policy measures as necessary.”

Besides, one member warned that “if the economic recovery is delayed, credit risk could materialize, leading to risk from the financial system.” “Top priority” is securing corporate finance and maintaining employment. ” Also, the BOJ should “continue to look for ways to improve the sustainability” of ETF and J-REIT purchases.

“If COVID-19 spreads again and economic activity declines, the CPI could remain in negative territory for an extended period and deflation could persist.”

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.