Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you are unlikely to be protected if something goes wrong. Take 2 minutes to learn more

Today alone, Bancor prices have increased by an impressive 7.27%. Although price action in this market still holds some upside promise, it appears that a headwind may have been triggered, considering the last price candle in this market. Nevertheless, let’s further study this market for more insight.

BNT Analysis Data:

BNT value now: $0.4409

Bancor market cap: $71,481,707

Bancor moving supply: 159,594,086

BNT Total Supply: 159,594,086

Bancor CoinMarketCap ranking: #328

Major Price Levels:

Top: $0.4459, $0.4509, and $0.4559

Base: $0.4409, $0.4379, and $0.4349

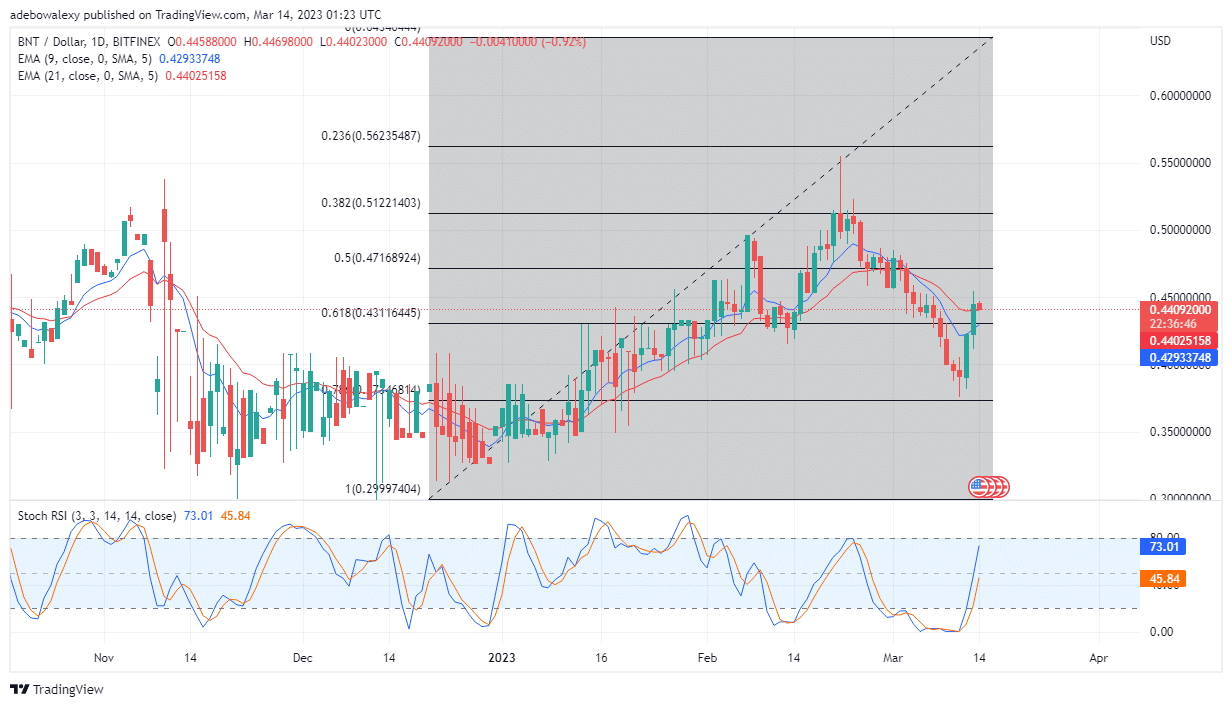

Bancor (BNT) Price Action Looks Weak After Breaking the 61.80 Fibonacci Level to the Upside

On the Bancor daily market, price action has quickly ramped up to break the resistance formed by the 61.80 Fibonacci retracement level. However, shortly after that, a red price candle appeared, showing that traders seem to have started going short. Furthermore, the last bearish price candle has brought the price of this crypto to align with the 21-day EMA line, which is above the 9-day EMA line. The RSI indicator curves are rising steeply towards the oversold area. Even the appearance of the last bearish price candle seems to not affect the direction of the MACD at this point. If the headwind fails to develop, the price may resume its upside path.

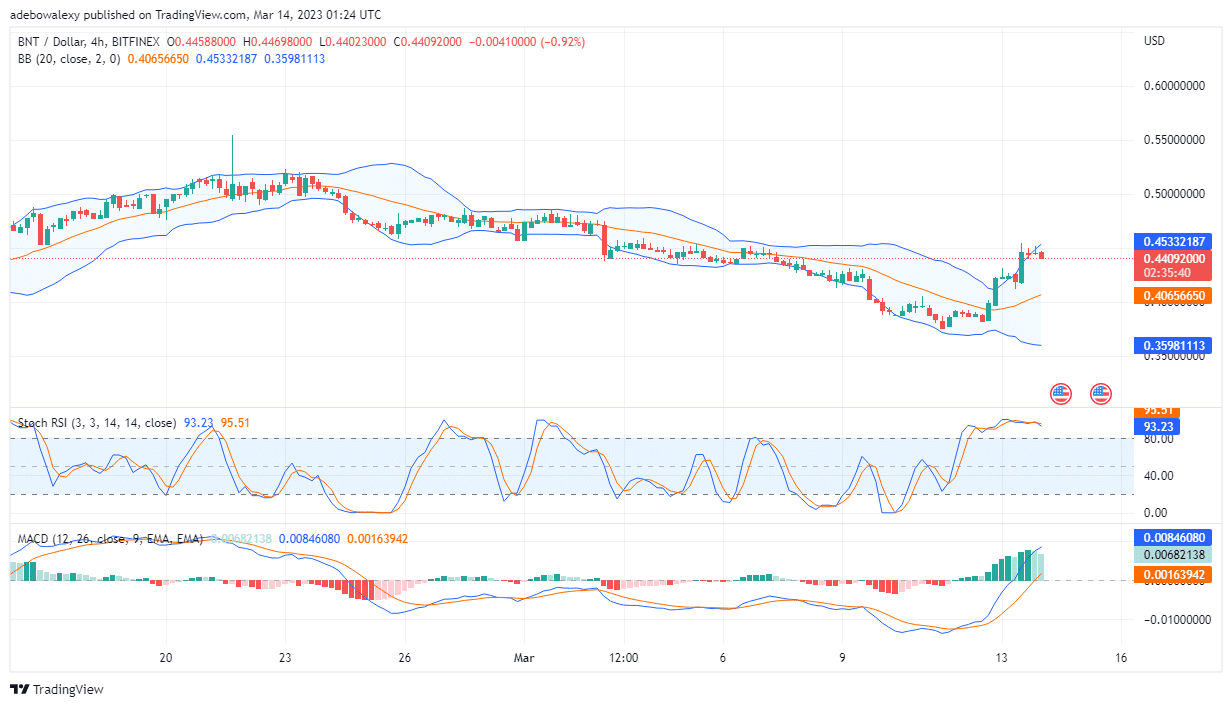

Bancor (BNT) Price Action Seems to Be Growing Weaker

On the BNT/USD 4-hour market, it appears that the headwind is quietly developing. Over the previous trading sessions, bears have been making attempts to sink price action lower. Nevertheless, it appears that the bulls are putting up a good fight, which has helped prevent the headwind from causing much damage. However, in the ongoing session, the headwind seems to be making progress. The last price candle here is a much larger red price candle. Also, the RSI lines are mangled in the overbought zone, while the MACD indicator is pointing out that upside momentum is weakening. The histogram bars of the MACD can be seen, growing shorter and looking pale green in appearance. Therefore, at this point, traders can place a shot order at $0.4309, as downward forces may continue to grow stronger. Otherwise, price action may keep rising towards the $0.4550 mark.

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.