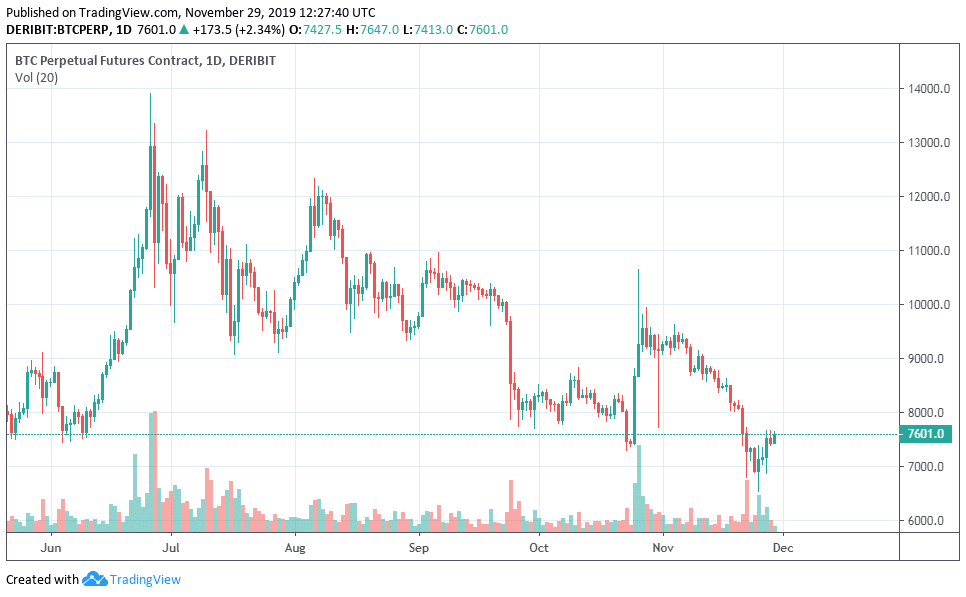

Bitcoin’s price is on a slow growth for a while now, owing to the recent selling shakeout in the entire crypto market. But recently, it appeared that Bitcoin has found its mid-year low around $6600 on November 25. This setup was quite synonymous to late October surge in volatility that saw after the Chinese President, Xi Ping made an announcement on the need to adopt cryptocurrency and Blockchain in the Country.

After the announcement, BTC hits $10370 within the space of three days, making the primary cryptocurrency to recording the highest daily surge in the history of Bitcoin and at the same time marking October high. Meanwhile, the three days positive sentiment was characterized by strong bullish candles.

Throughout this month, it was indeed a bearish momentum for Bitcoin after establishing a weekly low of $6600. However, Bitcoin has managed to bounce back to the $7000 price zones with the current price at $7520. Buying Bitcoin at this moment might be quite indecisive for some traders and investors as volume and volatility might seem relatively insignificant over the past days.

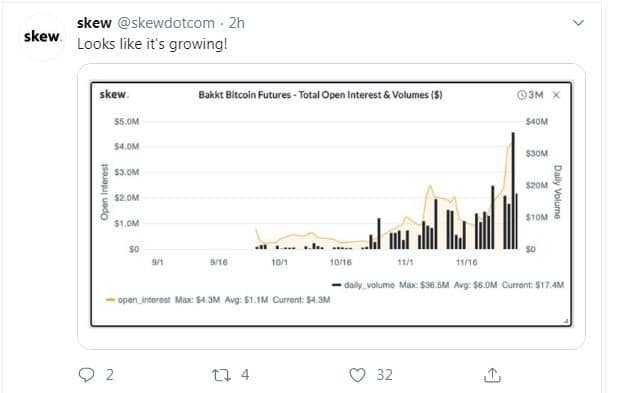

But following prominent twitter analytics by SKEW today, Bitcoin appeared to be rising by the day since the market recently recovered from the six-month low. As shown on the daily statistical graph below, Bakkt BTC Futures records an open interest and volume of about $40 million this week but now trading below a current daily volume of $20 million.

Well, in my own opinion, Bitcoin is technically regaining strength, though it might seem slow now due to subdued volatility. But the fact remains that there’s a need for a market to run a correction even before it can make major headway.

Validating a long-term bullish, BTC needs to reclaim $9000 price levels. On the other hand, we may start to consider shorting Bitcoin if the price drops below the six-month low. For now, the swing traders seem to be making heads in a long position.

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.