Avalanche has reached a significant milestone in September 2025, touching the $30 price mark for the first time since February. This surge reflects growing institutional confidence and impressive expansion in real-world asset tokenization on the platform.

The rally comes amid reports that the Avalanche Foundation is negotiating two major treasury deals worth $1 billion combined. These strategic moves aim to expand institutional exposure through dedicated crypto vehicles.

The first deal, led by Hivemind Capital, targets $500 million through a Nasdaq-listed company. The second involves a SPAC backed by Dragonfly Capital, also seeking $500 million in funding.

Real-World Assets Lead Growth

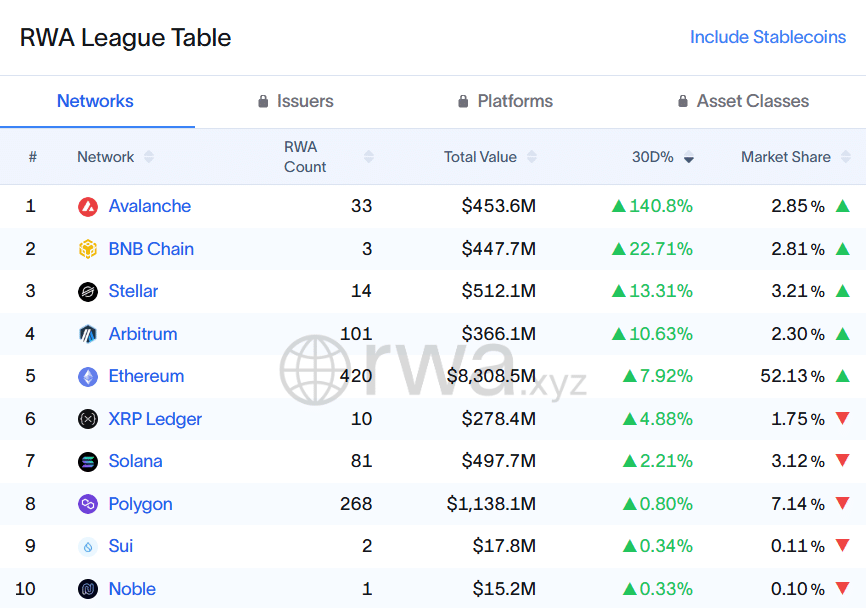

Avalanche’s position in the real-world asset sector has strengthened dramatically. The platform recorded 140% growth in RWA value over 30 days, surpassing $450 million total.

This growth stems largely from Janus Henderson’s on-chain CLO fund, which has brought over $250 million in tokenized assets to the network since early September.

The Janus Henderson Anemoy AAA CLO Fund represents a major validation of Avalanche’s infrastructure capabilities. This global investment firm manages over $379 billion in assets, making their blockchain adoption particularly significant for the crypto space.

Trading activity has also intensified significantly. Daily AVAX volume exceeded $1.8 billion, marking the highest levels since February. This increased activity suggests renewed trader interest and confidence in the token’s prospects.

Market Position and Future Outlook for Avalanche

Despite impressive growth metrics, Avalanche’s RWA market share remains modest at 2.82%. This reflects intense competition in the tokenization space, where multiple blockchain platforms compete for institutional adoption.

AVAX has gained 16% over the past week, with technical analysts eyeing potential targets above $40 by year-end. The current momentum builds on several positive developments, including Grayscale’s filing for a spot Avalanche ETF in August.

The combination of institutional treasury deals and strong RWA adoption creates a compelling narrative for Avalanche’s continued growth.

As traditional finance increasingly embraces blockchain technology, platforms like Avalanche that successfully bridge these worlds stand to benefit significantly.

With its capped supply of 720 million tokens and growing institutional backing, AVAX appears well-positioned for sustained growth throughout the remainder of 2025.

Interested In Trading The Market With A Trustworthy Partner? Try Eightcap Today.

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.