Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you are unlikely to be protected if something goes wrong. Take 2 minutes to learn more

Avalanche Price Forecast – February 27th

The Avalanche price forecast indicates that the market continues to experience strong selling pressure, with buyers failing to regain momentum as the price trades near the $20.000 key support level.

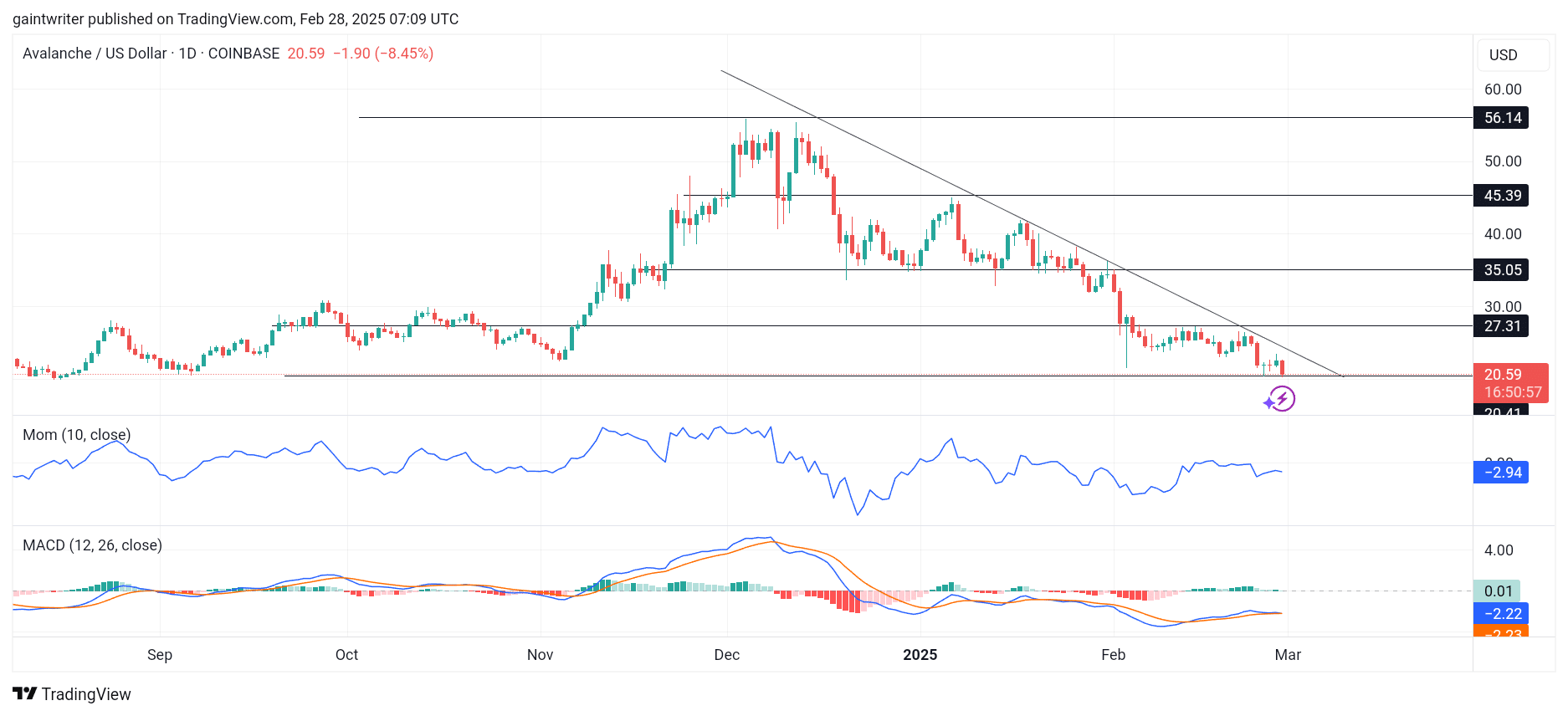

AVAXUSD Long-Term Trend: Bearish (Daily Chart)

Key Levels:

Support Levels: $20.000, $18.500

Resistance Levels: $25.000, $30.000

Avalanche Price Forecast – AVAXUSD Outlook

The MACD (Moving Average Convergence and Divergence) indicator remains below the mid-level, signaling continued bearish control. If sellers maintain their dominance, a breakdown below $20.000 could push AVAXUSD toward $18.500.

Conversely, if buyers step in at the $20.000 level, a short-term rebound toward $25.000 could materialize. This key level remains a critical decision point for Avalanche.

A breach below $20.000 could trigger a deeper decline toward $18.500, reinforcing the bearish outlook. However, if buyers successfully defend this support, a recovery toward the $25.000 resistance could be possible, though it would require strong bullish momentum.

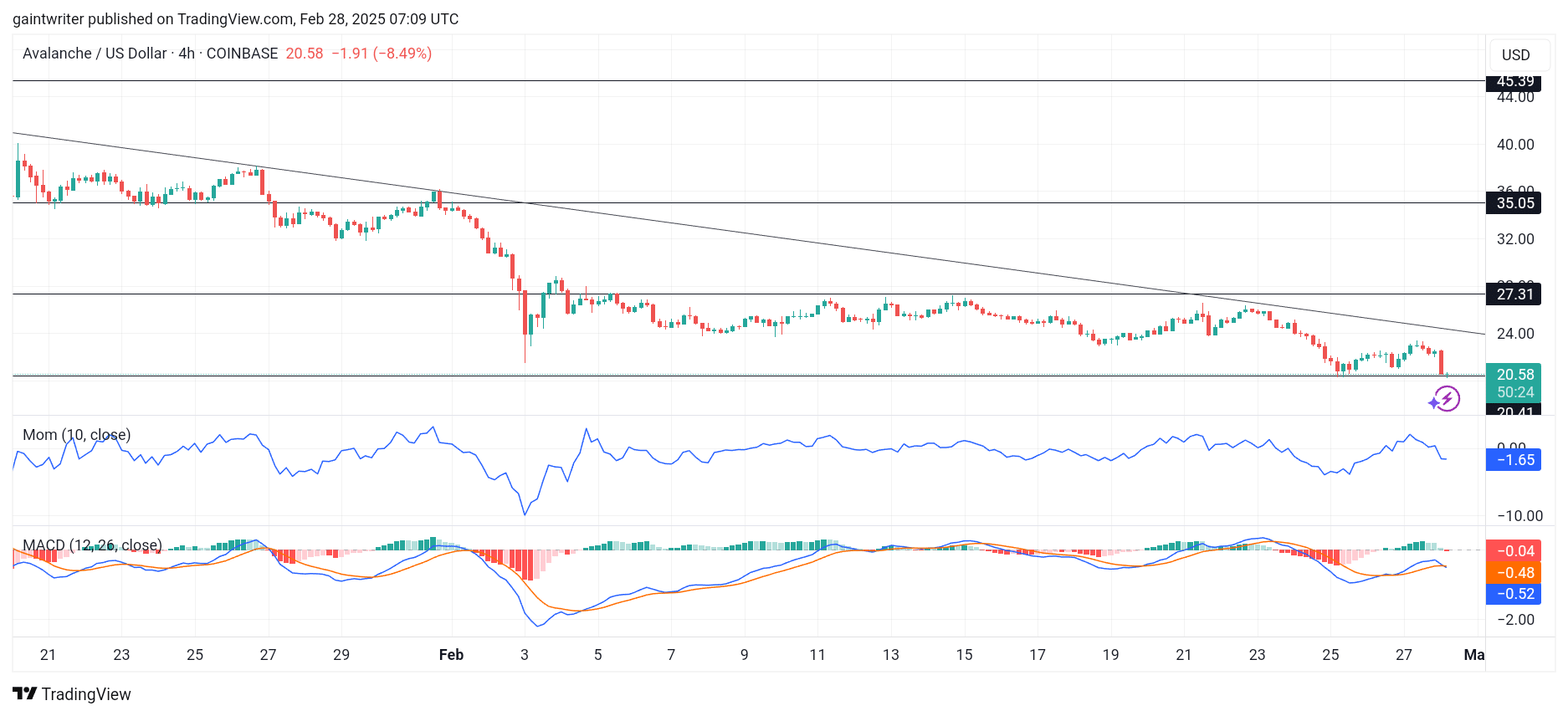

AVAXUSD Medium-Term Trend: Bearish Continuation (4-Hour Chart)

On the 4-hour chart, the bearish trend remains dominant, with no clear signs of reversal. The Momentum indicator suggests weak bullish attempts, indicating that sellers are still in control.

Make money without lifting your fingers: Start using a world-class auto trading solution

How To Buy Lucky Block – Guide, Tips & Insights | Learn 2 Trade

Note: Learn2.trade is not a financial advisor. Do your research before investing your funds in any financial asset, product, or event. We are not responsible for your investment results.

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.