AUDUSD price Analysis – July 2

The AUDUSD pair stayed through the first half of Thursday’s trading activity beyond the 0.6950 marks, although lacking any firm bullish traction. The spike was supported by the prevalent risk-on mood that eroded the US dollar’s safe-haven and gained perceived riskier currencies, including the AUD.

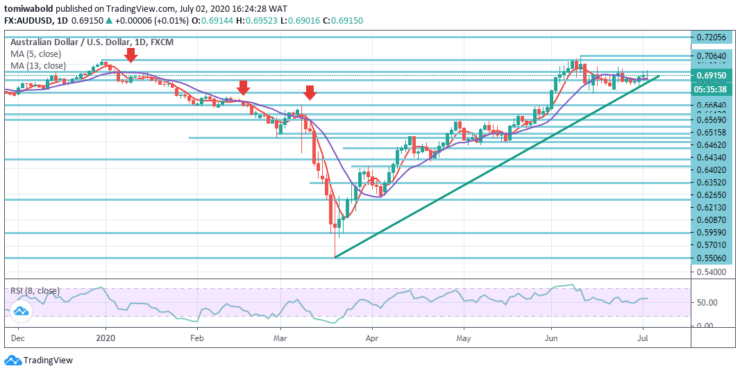

Key levels

Resistance Levels: 0.7205, 0.7064, 0.6938

Support Levels: 0.6777, 0.6462, 0.5906

Taking a look at the daily AUDUSD chart we can see that beneath lies the moving average of 5 and 13 with the support of the trendline. Furthermore, bulls are watching the latest 0.7064-level high for a potential upside breakout.

Technically, a simple split beyond favors bulls heading toward the north. Afterward, though, RSI conditions may challenge the bulls. On the downside, the pair’s declines beneath 0.6900 level may recall sellers attempting 0.6878 support convergence including moving average 5 and 13 with an ascending trend line as of June 15.

AUDUSD remains in horizontal trading from level 0.7064 and intraday bias stays initially neutral. At least one more shift down is required to expand the correction form to 0.7064 level. It is important to note that under the overbought zone, the high RSI conditions raise the chances of the pair’s further upside.

On the downside, a breach of 0.6777 level may shift the downside bias from 0.5506 to 0.7064 at 0.6462 levels for 38.2 percent retracement. Continued breach of 0.7064 level, however, may then revive the entire increase from 0.5506 level.

Note: Learn2.trade is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.