AUDUSD Price Analysis – November 19

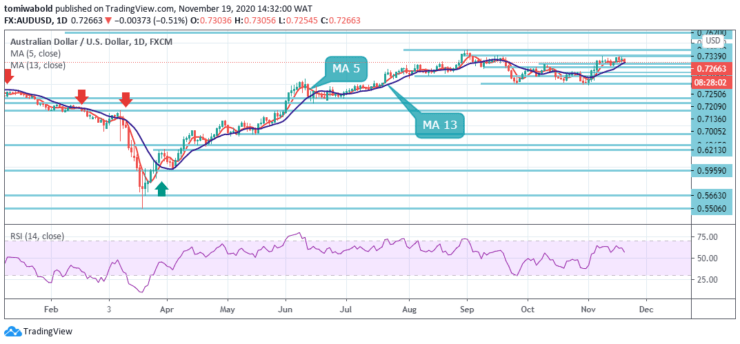

The AUDUSD pair plunges to 4th day in a row low on Thursday after buyers repeatedly failed to breach beyond the 0.7339 barriers, as the dollar rebound amid fresh COVID-19 infections and fading optimism about the vaccine. An additional decline beneath the 0.7200 marks may pave the way for further weakness.

Key Levels

Resistance Levels: 0.7620, 0.7413, 0.7250

Support Levels: 0.7209, .7136, 0.7005

AUDUSD visits minor support level at 0.7250 level at the beginning of the European session. A break lower is a sell signal targeting 0.7209/00 & 0.7136 levels, perhaps as far as strong support at 0.7100 level for profit-taking on shorts. All things being equal, the AUDUSD exchange rate could continue to edge lower during the following trading session.

The potential target for bears would be near the 0.7209 level. In the larger context, while the rebound from the 0.5506 level was strong, there is not enough evidence to confirm bullish trend reversal yet. That is, it could be just a correction inside the long term downtrend. On the upside, a breach of 0.7413 level will extend the rise from 0.5506 level higher.

AUDUSD stays bounded in a range from 0.7339 level and intraday bias stays neutral. A sustained increase is in consideration with a 0.7250 support level intact. Range trend from 0.7413 level may have finished with three waves to 0.7005 level.

On the upside, a break of 0.7339 level may approach a target and test on 0.7413 high level initially. The firm breach there may restart a larger rebound from the 0.5506 level. Nevertheless, on the downside, a breach of 0.7250 minor support level may probably extend the ranging trend from 0.7413 level with another plunging phase.

Note: Learn2.Trade is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.