AUDUSD Price Analysis – June 18

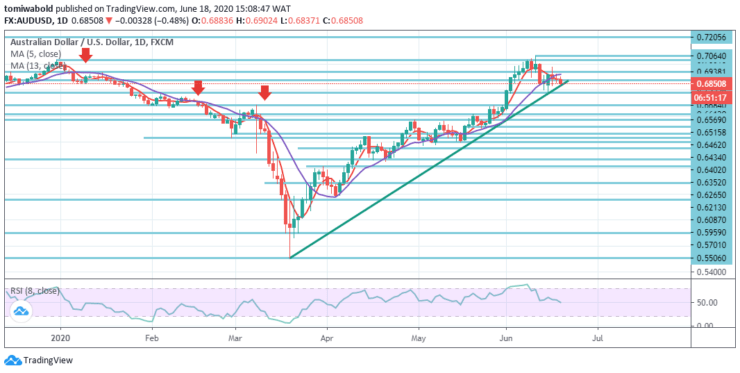

AUDUSD drops from 0.6902 intraday high to 0.6837 during trading early Thursday. As such, for the third day in a row, the pair posts 0.40 percent losses on a day whilst still inducing the sellers. As lower Asian stocks weighed, the Australian dollar stays in red, and weak Australia’s job statistics added to the negative tone.

Key Levels

Resistance Levels: 0.7205, 0.7064, 0.6938

Support Levels: 0.6777, 0.6462, 0.5906

The AUDUSD pair developed on its stable intraday ascend and have lately renewed daily highs, with bulls presently attempting to increase the traction beyond the 0.6900 thresholds further. Any significant positive change is expected to face a heavy opposition to 0.6938 level near the horizontal line.

On the flip side, weakness beneath the level of 0.6878 seems to drag the pair down towards the daily swing lows, around the level of 0.6837, and next to horizontal support at 0.6777 level.

AUDUSD’s intraday tendency stays neutral as it continues to trade sideways. On the positive side, a firm 0.7031/64-level breach is required to confirm the continuation of the rising trend. Or else risk in the scenario of a turnaround may remain moderately on the downside.

On the negative, the 0.6684 level breach would expand the 0.7064 decline trend to 38.2 percent retracement from 0.5506 to 0.7064 at 0.6462 levels. Extensive sideways pattern may be anticipated if the pair persists to trade beyond the ascending trendline, but the bullish signal requires the breaking of horizontal resistance at 0.6938 level.

Note: Learn2.trade is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.