AUDUSD Price Analysis – January 30

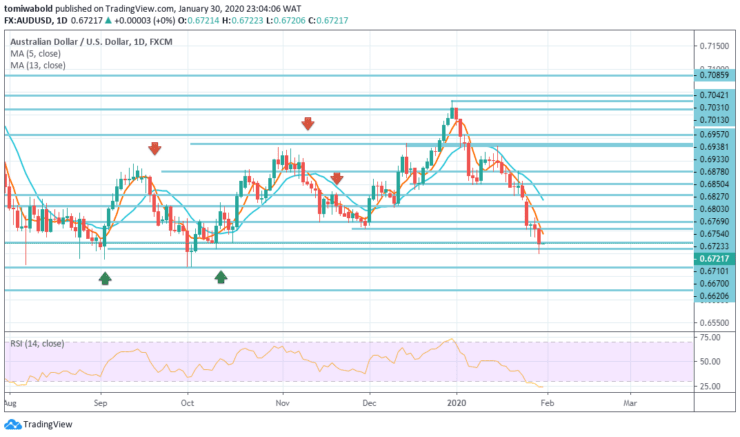

AUDUSD currency pair further declines during the American session on Thursday as the bitter market mood is affecting the sensitive Australian dollar. As of this writing, the pair was trading at its lowest level since late September at 0.6712, as it lost 0.6% daily.

Key Levels

Resistance Levels: 0.7085, 0.6933, 0.6827

Support Levels: 0.6700, 0.6670, 0.6620

AUDUSD Long term Trend: Bearish

Expectations for a corrective recovery in the Australian dollar for a higher extension was incorrect, as the Australian dollar fell to 0.6700 level before recovering. Momentum indicators are mostly neutral and the recent weakness in the Australian dollar appears to have stabilized.

We notice restricted downside risks and anticipate the Aussie to trade in a range like a manner for the time being, probably between 0.6723 and 0.6769 levels. However, the Australian dollar has not been out of sight just yet and the move past the 0.6827 level may indicate that the current weakness has stabilized.

AUDUSD Short term Trend: Bearish

The Australian dollar plunged versus the US dollar after brief consolidations and bias returned during the day down. The 0.7031 level decline is anticipated to continue the retest of the next 0.6670 level.

On the upside, above the 0.6769 level, minor resistance might change the daily bias neutral first. But the recovery may be contained below the support level of 0.6850, and the resistance has turned to bring another drop.

Instrument: AUDUSD

Order: Sell

Entry price: 0.6723

Stop: 0.6827

Target: 0.6670

Note: Learn2Trade.com is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.