AUDUSD Price Analysis – March 25

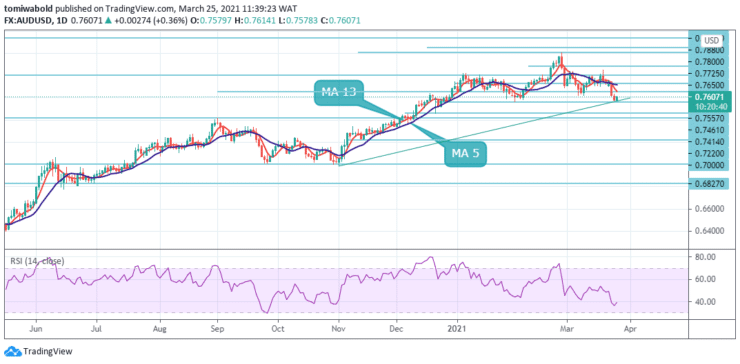

Early in the session on Thursday, the AUDUSD pair recovered after plunging to lows of $0.7578 level, however on a short-covering rebound on the pair is erasing much of the overnight losses after hitting its lowest since early February.

Key Levels

Resistance levels: $0.7800, $0.7725, $0.7650

Support Levels: $0.7557, $0.7461, $0.7414

AUDUSD Long term Trend: Ranging

The exchange rate is currently in a rebound at $0.7578 in an attempt to surpass the prior day’s high. AUDUSD may be poised for a breakout towards the MA 50 at the $0.7650 level. If the breakout emerges a surge to the 0.8000 level within this session may be anticipated. If the downward pressure holds though, bearish traders are likely to hit the next horizontal support line at 0.7461 level at oversold conditions of the RSI.

Meanwhile, an increased rally past the horizontal resistance level upside (now at 0.7650) may be seen. It might stay the optimal scenario given that it remains beyond the ascending trendline support (now at 0.7578). Continuous trading below the 0.7600 marks, though, may shift the emphasis back to a low level beneath 0.7578 afterward.

On the 4-hour timeframe, AUDUSD is actively reversing its downside movement from 0.7578 after a rebound. The pair was last traded in the 0.7600 area, practically unchanged over the day. A break above the MA 13 at 0.7620 is expected, followed by a return above the 0.7650 level.

Breaking the AUDUSD level of 0.7650 will suggests renewed growth from the level of 0.7578. The intraday trend is growing again. And the next target is the long-term level of 0.7800. On the other hand, a dip below the minor support level of 0.7557 could change the bearish bias and trigger sideways trading.

Note: Learn2.Trade is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.