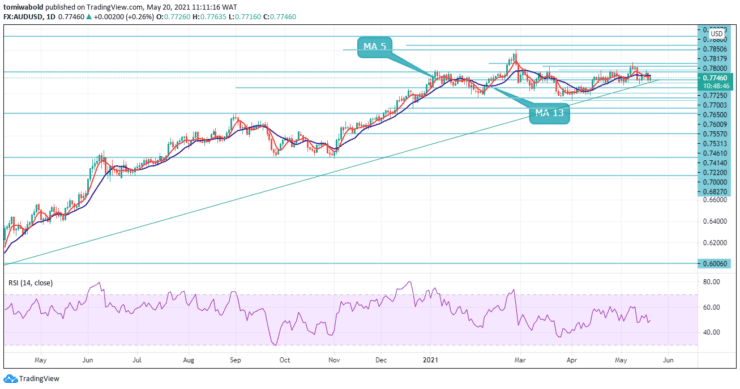

AUDUSD Price Analysis – May 20

AUDUSD rises to a new intraday high of 0.7763 at the time of this post in early Thursday, up 0.20 percent on the day. Before April’s job report sparked a corrective pullback, the Aussie pair had been grappling with the risk-off mood. Amid Aussie jobs data, the failure to break above the daily cloud, which may leave the downside vulnerable, should be avoided.

Key Levels

Resistance Levels: 0.7900, 0.7850, 0.7800

Support Levels: 0.7700, 0.7650, 0.7600

The exchange rate is roughly trading above the ascending trendline pattern, and a breakout towards the 0.7800 level may be imminent. If the breakout occurs from the mid 0.7700 regions, this session could see a surge to the 0.7850 level. On overbought conditions, the relative strength index stays around its midlines implying more room for the upside advance.

Bullish traders are likely to touch today’s horizontal resistance line at 0.7800 if the price breaks the moving average of 5 and 13 barriers. Another rally past the horizontal resistance level on the upside (currently at 0.7800) may occur. Given that price is still above the ascending trendline, it may remain the best scenario to aim at 0.7850. However, continued trading below the 0.7800 level could move the focus back to the 0.7600 regions.

Beyond the 0.7700 marks, the AUDUSD remains in consolidation, however with the intraday bias initially tilted to the upside. A further rise may be seen now that the 0.7700 marks have been surpassed. The short-term rise from 0.7513 to 0.7890 could reach 0.7900 in subsequent sessions.

However, given the persistent ranging condition in the 4 hour RSI, a return to the 0.7700 support level could imply a short-term topping. If that scenario plays out, the intraday bias will be shifted back to the downside as the market may correct towards a lower support level at 0.7650.

Note: Learn2.trade is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.