AUDUSD Price Analysis – March 26

The Aussie dollar stays undeterred by the Reserve Bank of Australia’s quantitative easing (QE) plan, as AUDUSD maintains its recovery momentum steady beyond 0.5900. The price is going back to yesterday’s 0.6073-level high, now trading around the 0.5959/65 levels, so far down 0.50 percent.

Key Levels

Resistance Levels: 0.7031, 0.6684, 6266

Support Levels: 0.5701, 0.5506, 0.5118

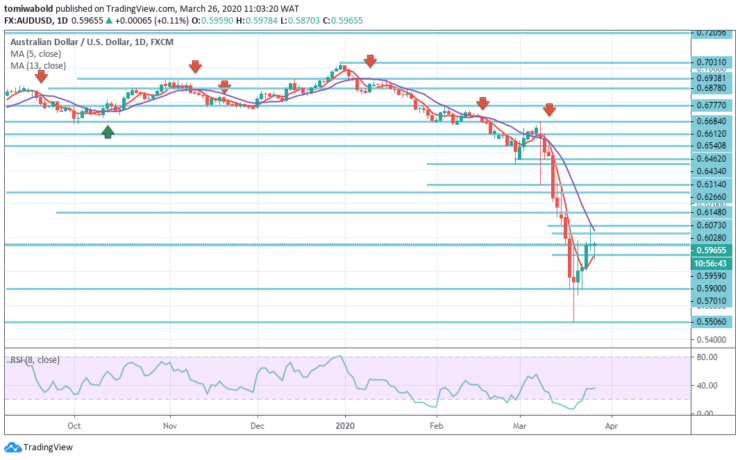

AUDUSD Long term Trend: Bearish

AUDUSD bulls will have to retain the level of 0.5900 to sustain short-term growth, but keeping past the level of 0.5959 is more optimistic towards 0.6028/50 until a 0.6073 level retest.

AUDUSD’s fall from 0.7031 (high) level is on the path in the recent trend. This is part of the broader steady decline from 1.1079 (high) level. The estimate of 61.8 percent from 0.7031 to 0.6878 at 0.5506 level is already achieved. There could be a sustainable break in the price to 0.5118 (low) level. Upright, it requires a break of 0.6684 resistance level to suggest long-term bottoming.

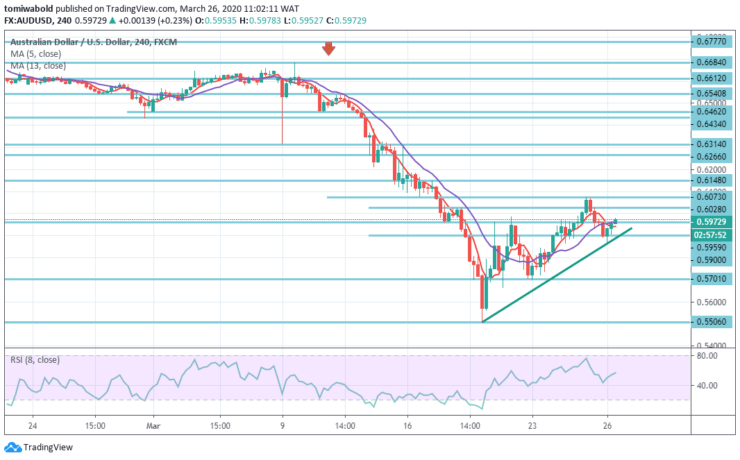

AUDUSD Short term Trend: Ranging

There is no shift in the trend of AUDUSD as consolidation from 0.5506 level continues. We can not rule out any further progress. However, recovery may contain a retracement of 61.8 percent from 0.6684 to 0.5506 at 0.6266 levels to usher in fall continuance.

On the contrary, a breakage of 0.5701 minor support level can initially alter bias back to the downside to re-test 0.5506 low level. Continued breakage of 0.6266 level, however, may diminish instant bearish scenario and alter attention back to 0.6684 resistance.

Instrument: AUDUSD

Order: Buy

Entry price: 0.5900

Stop: 0.5850

Target: 0.6028

Note: Learn2Trade.com is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.