Bears’ momentum increases

AUDUSD Price Analysis – 19 July

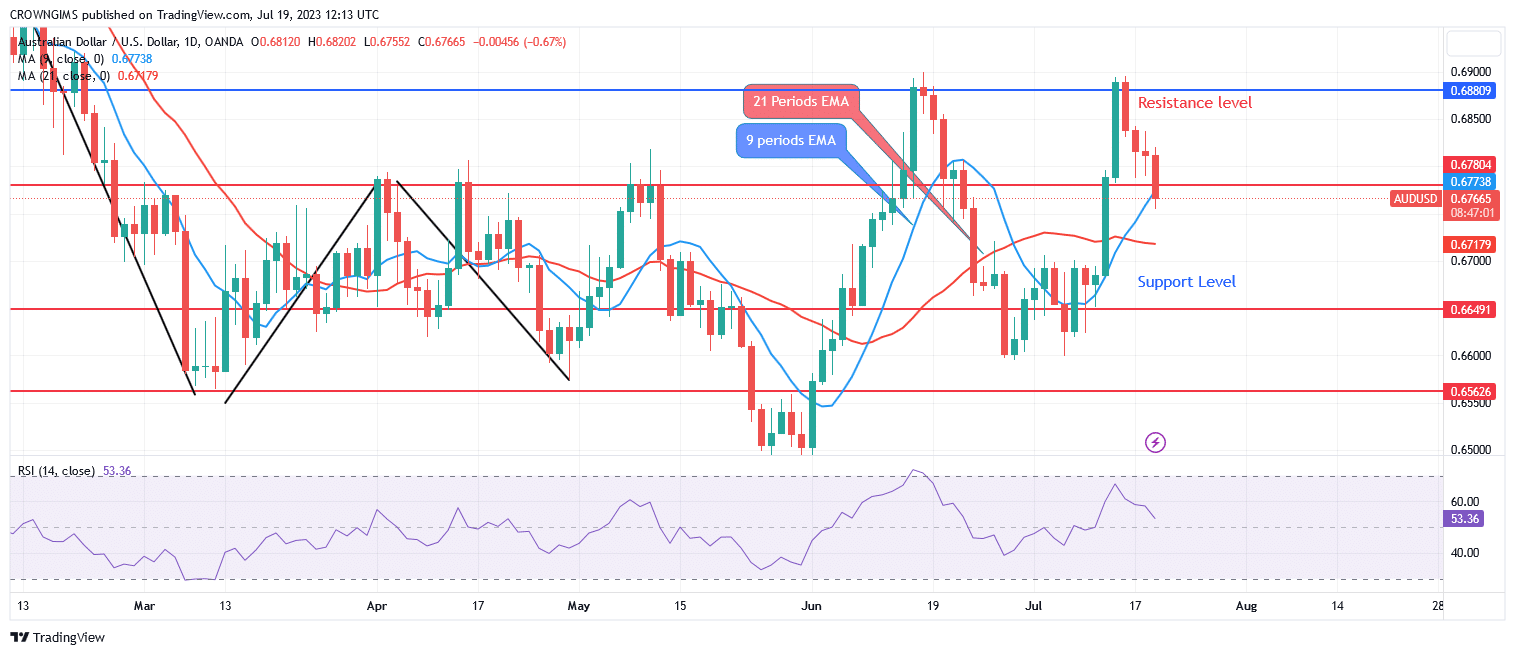

If buyers are able to hold the $0.66 support level, the AUDUSD may move above the $0.67, $0.68, and $0.69 resistance levels. The price may drop much further if sellers gain momentum, possibly reaching levels of $0.65 and $0.64 or even lower if the $0.66 support level is breached.

AUD/USD Market

Key levels:

Resistance levels: $0.67, $0.68, $0.69

Support levels: $0.66, $0.65, $0.64

AUDUSD Long-term Trend: Bearish

On the daily chart, AUDUSD is moving downward. Investor fervor caused the price to soar to a high of $0.68 on June 15. The following day, an evening star candle pattern could be seen at the same level, signaling that the bulls’ power had run out. A strong daily bearish candle gave sellers control of the AUDUSD market. The $0.66 level was tested after the $0.67 support level was breached. Following a price adjustment the previous week, Sellers remain in charge of the market.

When the currency pair trades above the 9-period and 21-period exponential moving averages, a bullish trend is clearly visible. If buyers are able to hold the $0.66 support level, the AUDUSD may move above the $0.67, $0.68, and $0.69 resistance levels. The price may drop much further if sellers gain momentum, possibly reaching levels of $0.65 and $0.64 or even lower if the $0.66 support level is breached.

AUDUSD medium-term Trend: Bearish

AUDUSD is bearish on the 4-hour chart. The price started to decline and move past the $0.67 support level last week. The price fell below its previous low of $0.67 and probed the $0.66 level while being supported by sellers at the target level. At the aforementioned level, the bulls were fighting against the negative trend. Currently, price is pulling back.

As a sign of a bearish market, AUDUSD is currently trading below the 9-period and 21-period exponential moving averages. A buy signal is being given by the relative strength index period 14 going upward at 46 levels which may be a pullback.

You can purchase Lucky Block – Guide, Tips & Insights | Learn 2 Trade here. Buy LBLOCK

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.