AUDUSD Price Analysis – January 14

AUDUSD pair continues upside move with a fresh bid during the European session, now extending the upside bias towards 0.7800 amid $2 trillion US stimulus plan announcement, as markets await further trading impetus.

Key Levels

Resistance Levels: 0.8170, 0.8136, 0.7800

Support Levels: 0.7725, 0.7635, 0.7461

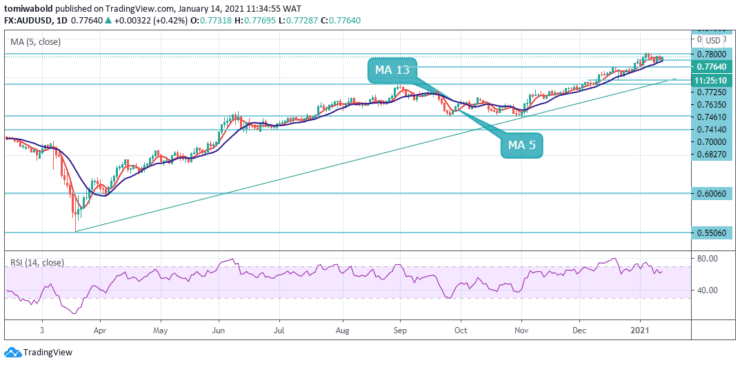

As seen on the daily charts, AUDUSD bulls need a sustained break above the 0.7800 level to retain the bullish pattern. The 0.7800 areas are also an obstacle to growth. Meanwhile, a pullback below the 13 moving average at 0.7700 may initially nullify the bullish sentiment and send AUDUSD mid-term sellers to a weekly low around mid 0.7700.

In a broader context, sustained trading past horizontal resistance at 0.7725 is a sign of medium-term bullish sentiment. However, AUDUSD may need to reverse the retracement from 1.1079 high to 0.5506 low at 0.7725 to finally signal the end of a long-term downtrend from 1.1079. A deviation from the 0.7725 level would instead maintain a long-term bearish trend.

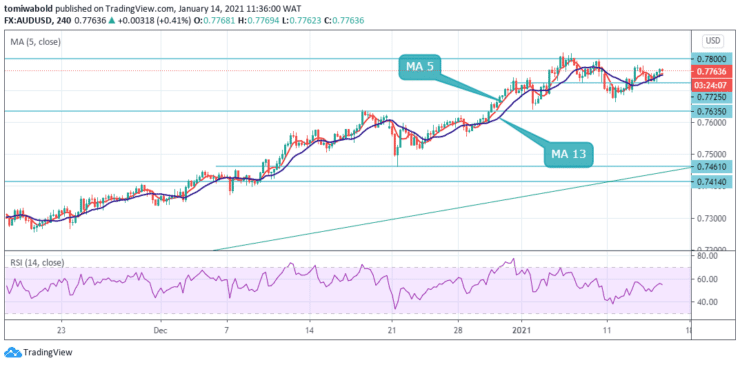

The AUDUSD shift remains neutral during the session, and further rally beneath 0.7800 is possible. On the other hand, a breakout of 0.7800 may sustain a larger upsurge from 0.5506 to 61.8%, forecast of 0.7414 from 0.7000 to 0.8170 level.

On the other hand, a breach of the 0.7635 support level would indicate a short-term top, subject to bearish divergence on the 4-hour RSI. Intraday bias may be reversed downward for a deeper correction towards the 0.7461 support level.

Note: Learn2.trade is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.