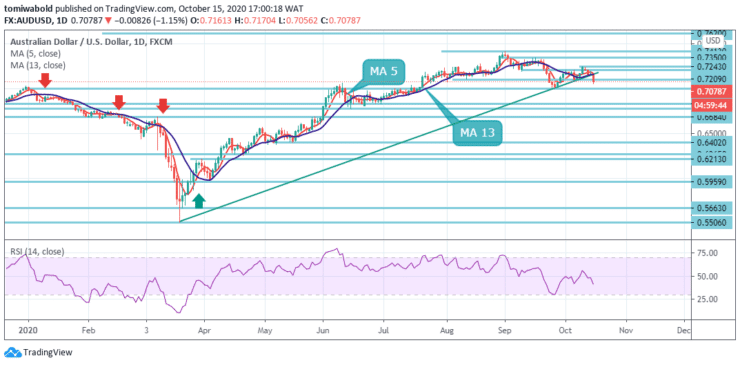

AUDUSD Price Analysis – October 15

AUDUSD added to its intraday losses and fell to a weekly low below 0.7100 at the start of the European session. Selling pressure around the AUDUSD pair intensified in the American session, knocking rates down to their lowest level in two weeks around 0.7056. The Australian dollar also remains under pressure amid the RBA rate cut in November.

Key Levels

Resistance Levels: 0.7413, 0.7350, 0.7209

Support Levels: 0.7003, 0.6832, 0.6684

AUDUSD is looking south, breaking through the trend line connecting the September 25 and October 7 lows early Thursday. A break of the ascending trend line downward indicates a renewed sell-off from the Sept. 1 high of 0.7413. Besides, MA 5 is about to cross MA 13 and enter bearish territory below zero.

Support for the breakout is a dip below -50 or a bearish 14-day RSI. Sustained trade below the 0.7100 level would support the bearish sentiment and indicate the bounce is complete. The focus will return to the 0.5506 low again.

On the 4-hour time frame, a strong breach of the AUDUSD 0.7100 level suggests that the recovery from 0.7003 has completed at 0.7243. The correction of the fall from the 0.7413 level should be ready to resume.

The intraday bias returned to the downtrend initially towards the 0.7003 level. while a breach may approach the 38.2% retracement from 0.5506 to 0.7413 at 0.6684 levels. On the other hand, a breach beyond the minor resistance levels of 0.7209 would weaken this bearish case and neutralize the bias first.

Note: Learn2.trade is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.